The operators of the traditional financial markets will discourage you, because your money in the stocks, futures or currency cross markets can be “resold” for an almost infinite number of times to millions of other investors, and this possibility of “money multiplication” is an opportunity too timing for an operator of investment banks and investment funds to let you invest your capital in bottles of fine whiskey of your exclusive property. Investing in whiskey is safe and a great alternative to stocks and shares, Learn why.

The collectible whisky sector has, in fact, developed on the initiative of individuals, almost as if the investment market in the broadest sense has kept this huge opportunity for profit and value conservation hidden from the attention of investors for decades.

After all, so far only whisky lovers due to family dowry or passion (and spending ability) have had access to this niche market but whose products are coveted by a much wider audience of investors than those who if you think.

The demographic factor

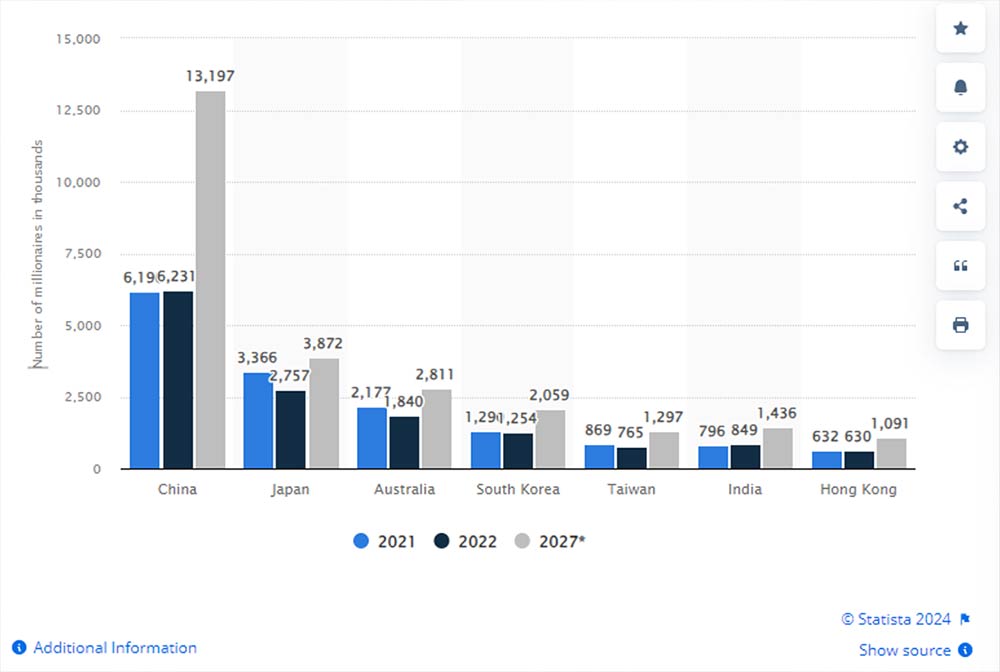

Suffice it to consider that in Asia alone, a piece of the world map that includes fifty percent of the world population, it is estimated that in 2027 there will be almost twenty-six million millionaires, a slice of potential investors who will literally devour the already scarce availability of bottles of Rare collectible whiskies.

Expectations of the demographic trend up to 2027 of Asian countries, which are foregone to be the largest importers of single malt whisky in the world. Source: Statista

Among them, a percentage of them will certainly consume a part of these pieces of authentic art in liquid form, which will further increase the prices of the “surviving” bottles.

Furthermore, more and more young people are entering the world of collectible whiskies to create their own treasure, now warehouse of the investment methods offered by the financial markets, which in most cases offer “refund promises” in exchange for a dematerialized security. Young people are those who, par excellence, are the most inclined to take alternative paths, and they are no exception even in the field of investments. Here there is a reference to our previous articles that it is necessary to make, especially with regard to cryptocurrencies and NFTs, sectors that we have already addressed, as they are part of the so-called alternative assets. In fact, collectible whiskey has a peculiarity: the underlying asset is the ownership of a tangible asset, which is not the case for the other two sectors mentioned above (for further information, at the links ).

Reasons Why Investing in Whiskey Is Safe

The field of collectible whisky has very well defined evaluation standards, but a very wide price range. Bottles that can be purchased today for a few hundred euros have the conditions (not known to everyone, but to connoisseurs and investment professionals in this area) to obtain a tripling or more in value within a few years.

Research expertise and ability

Sometimes the upward development of prices occurs mostly within a few months, for this reason it is advisable to rely on companies specialized in the procurement of bottles and in the study of price trends, and which can suggest to the investor the right moments of entry and exit from each position in your collection. Usually, those who know whiskies with high potential for increasing value do not talk about them with the next potential person interested in those few bottles that already exist.

Black Bowmore 29 Year Old: The first bottle went on sale at Oddbins in 1993 for the sum of £110. Today one of them, if one were to be found, would cost no less than £28,000

The secret of the value retention of fine whisky bottles is precisely in the limited supply: when a product is available in abundant quantities and is easily replicable on an industrial scale, the law of supply and demand will cause its price to drop; vice versa, given that we speak of “valuable” whisky only when we are faced with spirits produced with restrictive criteria, bottled in an exclusive manner and available in a limited or even small number of pieces, the value of each piece can only rise to increase in demand.

But, given that the number of people interested in investment whisky has been increasing rapidly for decades, this means that the demand is already exorbitant compared to the supply and that the search for specific bottles can become a real hunt for treasure for the inexperienced investor. To overcome this inconvenience, all you have to do is contact us as per the references at the end of this article, to take advantage of the benefits of a safe investment with unthinkable profits.

The certainty of a tangible asset: investing in whiskey is safe

It is undeniable that if, in addition to exciting graphs on the performance of an asset in which you have invested, you are also the owner of a physical asset, which can be resold at any time and whose value is incorporated into its very tangibility, the gratification is complete, at difference in equity securities, investment fund shares or debt securities, on which the peace of mind of not having “lost” your money will reside solely in fundamentals advertised on sector portals, and in the information of the body or company issuing the securities above.

Those who prefer to have a concrete and tangible value compared to the payment of a sum of capital prefer tangible assets, such as bottles of fine whisky. The security of this asset is such that almost every asset management company and every SICAV today has its own share invested in collectible whiskies in its sector dedicated to alternative assets. This is another reason why the already limited availability of these goods is destined to reduce further.

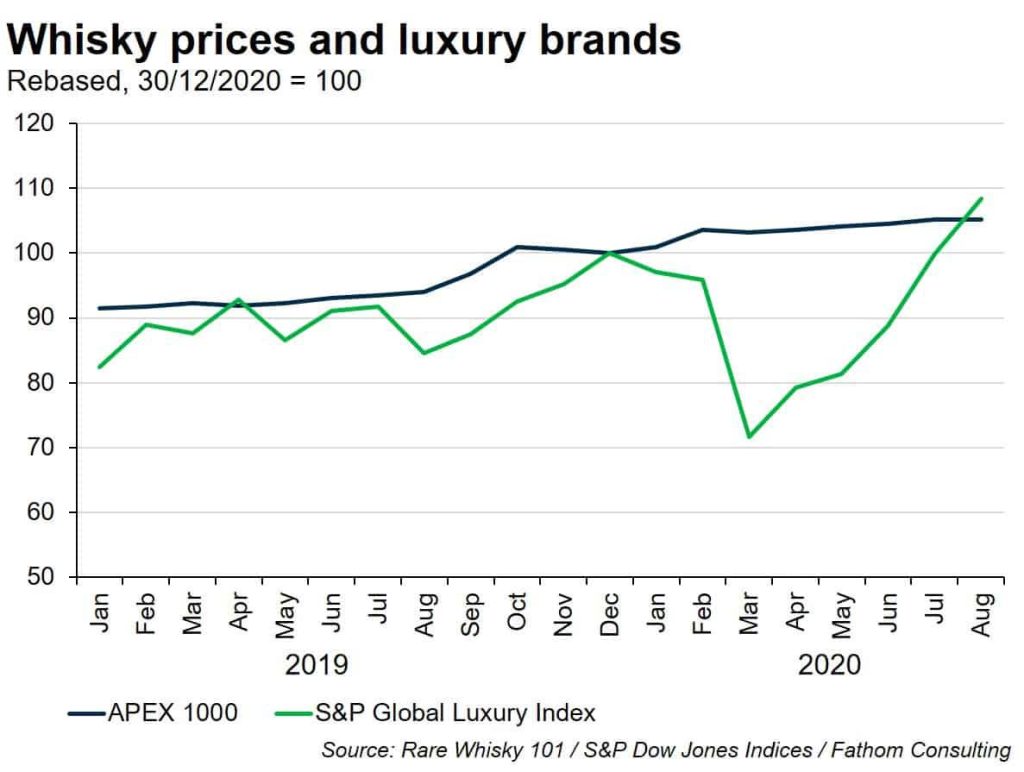

This is how a safe haven asset should behave: grow constantly, without price “holes”, which instead would be a symptom of being influenced by exogenous market factors. Source: Rare Whiskey 101 / S&P Dow Jones Indices/Fathom Consulting

For years now, investment funds have also been interested in collectible whiskies, however it is difficult to know, simply because when a market is flourishing, deals are done in silence.

Platinum Whisky Investment Fund and Spirited Funds/ETFMG are just two examples of investment funds in collectible whisky bottles, but the ways of approaching this fascinating and profitable world are not only those of the fund: there are jealously guarded “corporate” collections from the same distilleries and auction houses, from conventional banks, from trust companies, not to mention those secured in trusts and asset funds.

From coveted and increasingly rare goods, to treasures whose increase in value has a hyperbolic trend compared to the increase in demand, because, sooner or later, some wealthy connoisseur and jealous custodian of these bottled jewels will have the desire to test the wisdom and exclusivity that the precious liquid imbibes. And the rarity of that bottle becomes, as if by magic, uniqueness!

Why invest with The Spirits Club?

Our expertise is to identify the labels suitable for investment purposes and capable of generating profits above the market average.

- Investment in rare and prestigious bottles worldwide

- High experience in the search and availability of bottles

- Product and management transparency

- Exclusive ownership of the investor

- Pool of experts at the top of world collecting in spirits

- Portfolio managers experienced in the management of luxury assets

- Ongoing advisory approach to investors

- Indication of the best moment of liquidation of the product

- Possibility to liquidate at any time in case of need.