Among the varied investment landscape, investments in rare whiskies and fine spirits stand out in particular.

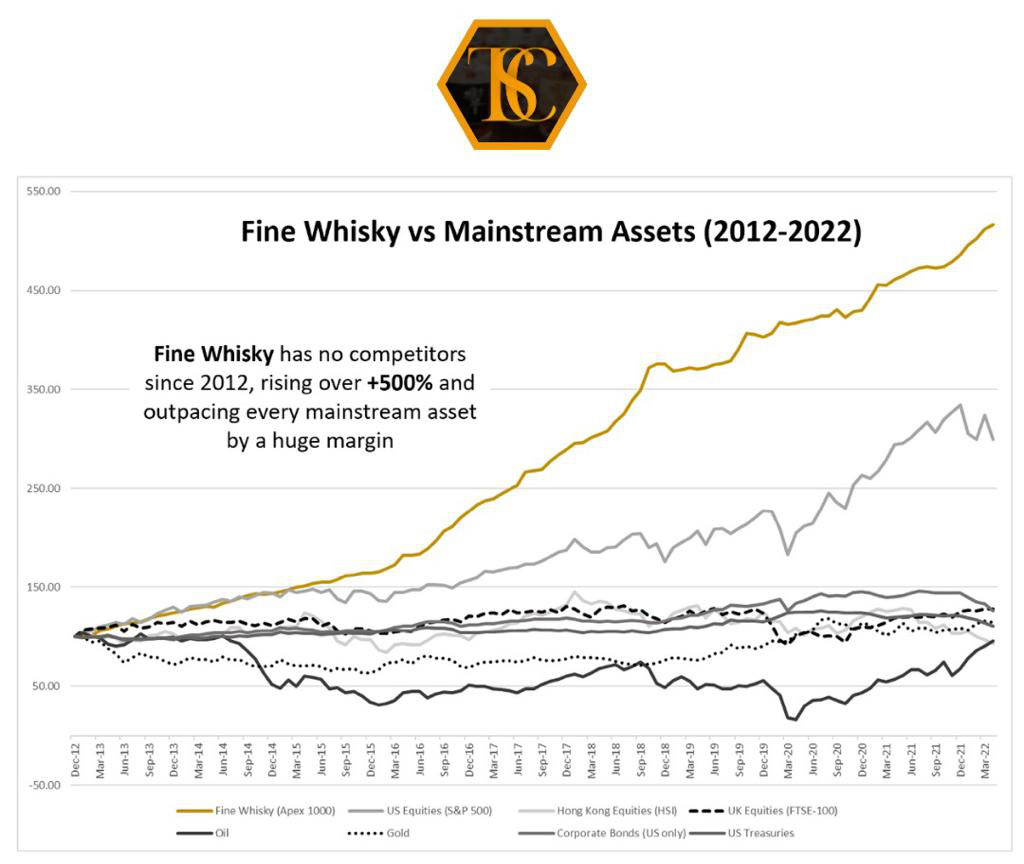

Investing in fine spirits is the typical example of an investment that has no correlation with the global market.

What does this statement mean ?

It means that whether the financial market is positive or negative, its fluctuations have no impact and no repercussions on the value of the collections, which will continue to increase their value indiscriminately. That’s why it’s safe to invest in fine spirits.

The main reason why this happens lies in the intrinsic characteristic of fine spirits.

These collections, which fall into the extra luxury category, are safe haven assets that benefit from the strong brand positioning of the producing distilleries and the extreme scarcity of production of the collections themselves.

We are talking, in fact, about a production of fine bottles that tends never to exceed 500 bottles per type of spirit, to be generous, and which can sometimes be limited to the production of one and only one bottle.

It is clear, therefore, that owning a bottle of this prestige, produced in a super limited edition, means in fact owning a rare, super-requested and sought-after good.

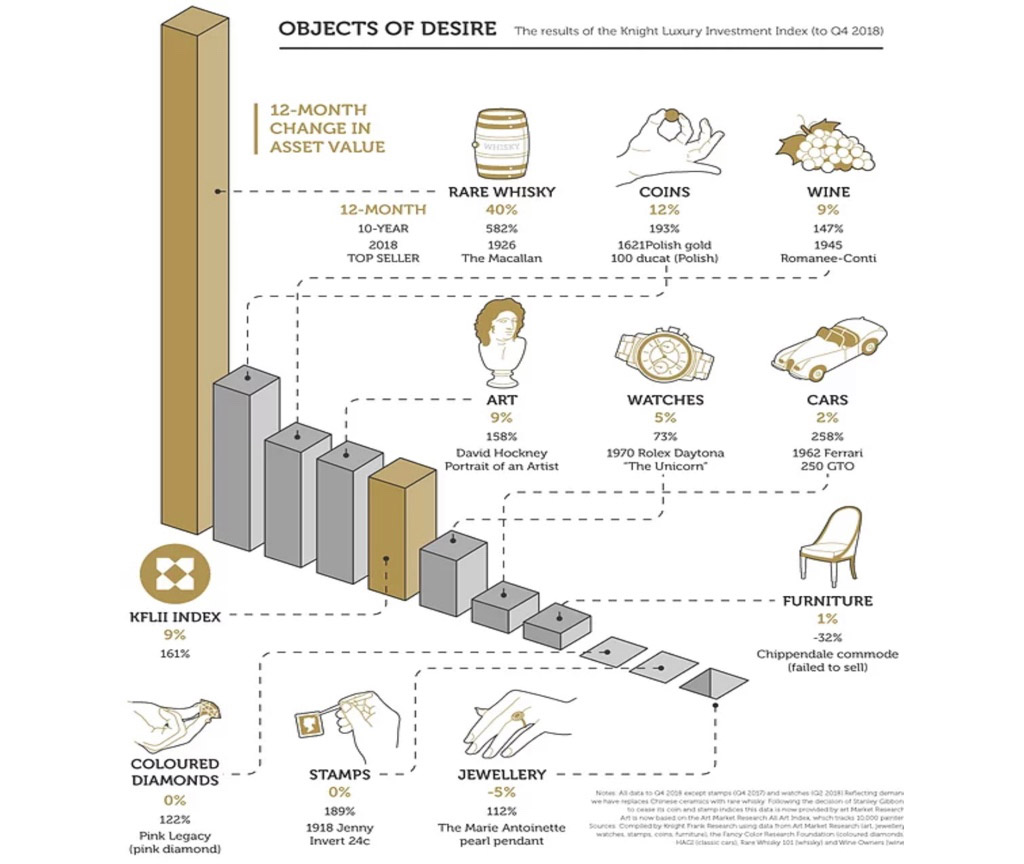

The reason why, in fact, these goods continue to steadily increase in value over time, without stalls or collapses in value, as happens with other collectibles such as bags, jewelry, works of art, is due to the fact that bottles of fine spirits have a large market that incessantly demands them.

In fact, it is precisely this continuous and unstoppable demand for fine bottles, combined with their production, which is always extremely small, that strongly affects the increase in value of these collections.

Around fine whiskey, there is an unsatiable hunger.

In addition to the classic and iconic collectors and consumers of fine spirits, there are new emerging markets such as India and China, whose total annual consumption exceeds 70%.

Not just new countries or multinationals; this lucrative market sector also includes noble families and Hollywood stars.

In fact, they are the ones who request the preparation of extremely valuable collections on the occasion of their important events or who finance the opening of their own distilleries.

Also for these reasons, the demand for fine whisky collections is constantly growing.

Its average annual performance is estimated at around 25%-30% per year.

Intorno al whisky di pregio, c’è una fame insaziabile.

An insatiable demand for rare whisky arises in recent year, therefore, which production cannot be and could not even satisfy.

Important aging of whisky bottles cannot be multiplied from one day to the next.

Other collectibles, on the other hand, which are produced in larger quantities or cannot be drunk and consumed, instead suffer a halt in the increase in value and we could therefore say that they are assets linked to particular demands or “fashions” of the market.

The constant demand for rare whisky, on the other hand, has never stopped.

Here, in fact, unlike other investment sectors, you will also meet multiple categories of users interested in whisky, consumers, investors and collectors.

Not only that, investing in fine spirits means investing in a tangible asset, which means that you become the full owner of a physical, material asset, consisting of bottles of spirits.

With the logical and important consequence that those who invest in this asset have the guarantee of full ownership and possession of the bottles.

Do you need to be an expert to invest in fine spirits?

No, investing in fine spirits is to be considered as an excellent alternative to classic financial investments, but is better to be guide from experts.

The most important task of our company is to know how to choose the collections that will increase their value over time, strictly discarding those bottles that are only excellent for consumption and that do not fall into the highest meaning of collecting.

The Spirits Club offers, in fact, a fully managed service to its investor customers, from the choice of the collections to buy, to the updating of the portfolio, up to the resale of the collections with profit in the market.

Another very important benefit of investing in fine spirits lies in the exemption from taxation.

The sale of the fine spirit is, in fact, part of the legal case of the occasional sale of a collector’s item, a circumstance that makes it de facto exempt from taxation on capital gains.