The word “asset” is thus literally defined: “English term which indicates, in a very broad sense, any material or immaterial entity susceptible to economic evaluation for a certain subject. In the absence of a satisfactory classification, one can resort to the classic distinction between tangible and intangible assets”.

A tangible asset or a traditional financial product?

When you find yourself choosing where to allocate your capital, it is needed to answer a series of questions, including: do we have other capital already invested, and where? How much confidence do we have in the financial markets? What is our experience in intangible investments? Do we know the difference between a stock and a bond? Do we know what a currency cross rate is? Do we know the difference between a futures contract and a CFD? Do we know the explicit and hidden costs of holding an open position for multiple weeks or months on one of these financial products?

If exhaustive answers hesitate to reach the above questions, it means that your experience in the financial field is limited, and therefore you are potentially exposed to large risks of losing part or all of your capital, if you invest in financial products of a certain complexity; or that you have already had unflattering experiences in the field, and prefer to think about something more… concrete.

Figure 1: pure financial products, represented by indices that replicate or anticipate the performance of an underlying (currency crosses in the case of FOREX market products, raw materials in the case of products listed on the CME, options or bonds, etc.) are exposed to geopolitical risks and closely related to each other, this is why it is essential to have a share of capital invested in physical assets that can guarantee the concreteness of full ownership of the “instrument” on which to place one’s profit expectations.

Here, tangible assets (or tangible assets) come to the aid of the investor who seeks security when allocating his capital for future returns.

Tangible assets certainly include all precious goods, starting with metals (gold and platinum, first and foremost), continuing with minerals (among which diamonds are the most precious), and ending with collectibles (cars , philatelic articles, works of art, coins, watches, etc.).

Many of these goods, unfortunately, have been “fashionable goods”, in the sense that they have had their echo only in a predefined period of time, gradually losing their prestige as well as their value over time.

Among the goods that were not just a must of the moment, there are undoubtedly bottles of rare spirits, goods produced in limited and very limited editions (series of up to a maximum of 400 pieces worldwide). These bottles have the characteristic of being both “consumable” goods, as the liquids contained in them are edible, and profitable activities capable of guaranteeing the initial purchase value and double-digit returns in the medium and short term.

Figure 2: Here is an example of return in value from the purchase and subsequent resale of bottles of rare spirits: +58.5% in 16 months. All this while having ownership of a physical good of limited availability.

Investment models: prudent, balanced and dynamic

There are basically three investment models, which outline the purposes and “temperament” of the investor.

If he simply wants to preserve the value of his capital, a prudent investment model will be indicated which, in the face of limited profitability, usually close to the current inflation rate, exposes the investor to the risk of losing part or all of the extremely limited capital. For this purpose, the bond sector is usually used, specifically government debt bonds from countries with the highest solvency index. From this investment model you will expect to protect your capital from the inevitable erosion caused by the loss of value of money, and nothing more.

For those who want to make greater profits, although not exposing themselves, however, to the risks of capital loss typical of more volatile and highly leveraged products, there are so-called “balanced” models, in which the capital to be invested will be allocated in a mix of equity, bond and occasionally currency assets, the latter adopted for the sole purpose of “capturing” potential losses of the currency sectors in which one may have invested. In a balanced model we usually chase the return objective of 2-2.5 points above the inflation rate, a target which too often is a chimera due to a multiplicity of exogenous factors that influence the expected return of the assets chosen for the investment.

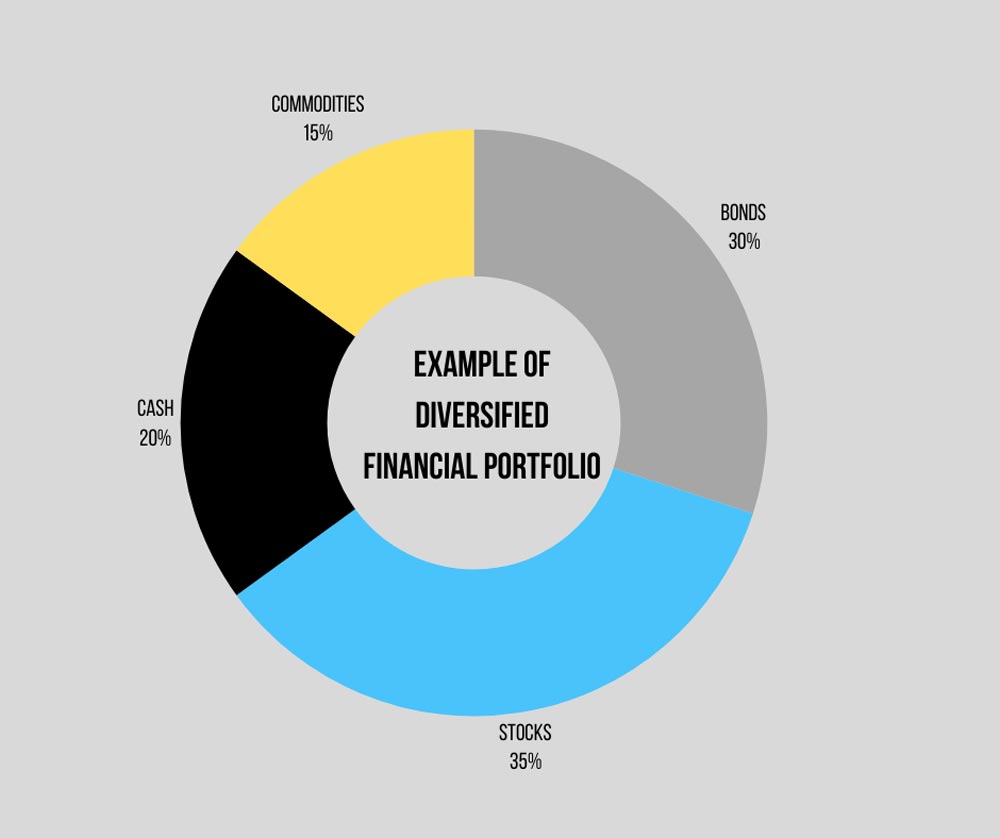

Figure 3: Example of diversification of a financial investment portfolio on a balanced model. The portion of cash and that allocated to raw materials and precious items are the areas of interest for investing in collectible spirits, since these certainly fall within precious assets and furthermore, being physical assets owned by the investor which ensure the value , protect the same fraction allocated to “cash” from inflationary deterioration, increasing it in the short and medium term more than any other asset.

The riskiest and, potentially, most profitable investment model is the dynamic one, in which there are often investments in more or less complex financial products, such as derivative contracts and options. A pure dynamic investment is usually undertaken for speculative purposes, therefore exploiting a particular momentary market trend to derive the greatest possible profit in a short or very short period of time.

This model is not suitable for those who have the aim of preserving capital and at the same time ensuring solid and constant returns, in fact it falls within the niche of financial trading, which is a world extremely distant from the character of the asset of which The Spirits Club takes care; however, this preamble is appropriate to better understand how it is possible that an asset such as the investment in collectible spirits, characterized by average returns of 30% per year, can also have the conservative characteristic typical of so-called prudent models.

Collectible spirits: the safe haven asset with double-digit returns

As we have repeatedly repeated, not only in this article, but also in other contributions to The Spirits Club blog, collectible spirits represent an exception to the market rule: the more you risk, the more chance you have of earning from the investment.

A bottle of rare spirit of collectible interest has, first of all, the characteristic of being so safe from the point of view of protecting the invested capital, that it is universally considered a “safe haven”.

Figure 4: if you are still skeptical about the real meaning of rare spirit, here is an example: Macallan The Horizon, born from the collaboration of the famous distillery with Bentley Motors, was released on the market at a base retail price of USD 50,000, and it is unknown the print run, i.e. how many pieces were produced in total. An increase in value of this bottle of around 300% in the space of a few years can be estimated.

Nonetheless, it is also reductive to compare it to physical gold, as the precious metal is still influenced by geopolitical events and crises in the top-player countries in the world economy and finance, because it is always available, whereas whiskey is rare (for example) has as a requirement that increases it and ensures the price increase precisely the fact of being “rare”, therefore produced in a limited or very limited series, and further it is characterized by its consumability, as an edible alcoholic product, which will reduce the quantity of bottles available will further increase over time and will inexorably increase the value of the “surviving” bottles and therefore available for purchase.

The hunt for bottles of rare spirits drags with it the prices of bottles newly placed on the market since the first release, but there is still a way to purchase pieces at very convenient prices which ensure unthinkable returns in the space of a few months, in some cases even doubled the purchase price.

We were talking about the dual value of investment goods as well as safe-haven assets of bottles of fine spirits: this pair of characteristics is almost always antithetical in the financial world, this is because a financial instrument, as an intangible asset, has as its underlying certification, which is equivalent to a performance promised exclusively on expectations and on the analysis of the past performance of that specific product: fundamental technical analysis technologies, however, that the future cannot be predicted from the past, except, perhaps, to be able to deduce it the behavior of the price trend of that particular product.

In the case of collectible bottles of spirits, however, we physically own the object of our investment: a capital guaranteed by the asset being invested, therefore, which in all respects constitutes the purchase of a rare physical asset. This is the key to the exceptional remunerative power of collectible spirits, compared to any other investment in other physical and intangible assets.

Why invest with The Spirits Club?

Our expertise is to identify the labels suitable for investment purposes and capable of generating profits above the market average.

- Investment in rare and prestigious bottles worldwide

- High experience in the search and availability of bottles

- Product and management transparency

- Exclusive ownership of the investor

- Pool of experts at the top of world collecting in spirits

- Portfolio managers experienced in the management of luxury assets

- Ongoing advisory approach to investors

- Indication of the best moment of liquidation of the product

- Possibility to liquidate at any time in case of need.