“Aquavitae“: Literally translated from the Latin aqua di vita, that is, water that incorporates life itself, and gives it up and gives it to those who drink it. Whiskey is, technically speaking, a cereal brandy. But there are whiskies and… whisky! Conventionally, the later are used to include those sought-after spirits of higher quality (and unavailability -ed). Rare whiskey has always been considered a truly guarded store of value among the wealthiest families, but also a product intended for consumption during events of particular prestige, extremely coveted in various historical periods around the world. Let’s see how history has taken us to venerate more and more the precious liquid contained in a few but highly coveted bottles.

The Birth of Interest Around Rare Whiskey

To understand why human beings appreciate bottles of rare whisky to the point of attributing an ever-increasing value to them, some historical notes are helpful, which dates the creation of a cereal-based distillate back to 1494, in Scotland. This is not proof that before that date there was not at all what we now call whisky, but if nothing else it helps us to establish a conceptual “zero point” from which we can understand the reasons for this universally recognized interest in fine whiskies.

Abu Musa Jabir ibn Hayyan (721-815 AD) was the inventor of distillation, thanks to the creation of the first still of which there is historical trace. In the beginning, the “spirit” thus obtained was used as fuel or as a medicinal substance. Later, the edibility of alcohols obtained using certain raw materials was discovered.

Let’s take another big step back, that is, to the time of the Persians (1000 B.C.): the search for the “quintessence”, that is, for a fifth element after water, air, earth and fire. This element can be translated biblically as Spirit, the energy that man guides and that he cannot understand, nor rationally explain, which gave rise to the things of Creation and which regulate the four elements mentioned above, as well as the souls of living beings, in their coexistence in Nature and interaction.

Given this rather spiritual preamble, we can understand why this precious liquid has always been the object of observation in the various stages of maturation, jealous care and a certain veneration by noble families who passed it on as an inheritance, wealthy collectors and the nouveau riche.

The appeal of a “rare” commodity has made fine and rare whiskey a real safe haven, free from the influences of geopolitical events and economic and financial crises.

Does fine or rare whiskey owe its appeal to the poorest spirit?

It is historically certain that various civil and criminal uprisings have taken place around the most coveted alcoholic beverage in the old and new worlds, since the eighteenth century, that is, since the Scots and Irish, permanently settled on the territory of what would later become the United States of America, established the production of whisky in those territories until then without even the existence of such a distillate. Thus the governments, noticing the growing consumption of this alcohol, tried on several occasions, then succeeded, to place the mite of the state monopoly. This created in the centuries to come, culminating in the 20s of the twentieth century, conflicts and real wars on the ground between producers and government agents, with bloody drifts.

In this climate of tension and violence, illicit activities managed by criminal families flourished, thanks to their connections that, from the English suburbs, allowed consignments of whiskey, even very poor quality, to illegally transit through the Ireland-Canada bridge, through which alcohol was distributed widely and clandestinely throughout the territory of North America.

Of course, even in cereal brandy (aka whiskey) there were hierarchical divisions between those who could afford the high-quality product, even the most sought-after and rare, and the product intended for the working class and the poor in general.

The Prohibition era (ca. 1900-1920) saw a real guerrilla war between governments and alcohol smugglers from Scotland and Ireland, who through Canada were able to supply whiskey, rum and gin to the entire area of the North Americas

In a nutshell, just as there can be no good without evil, in the same way smuggled whiskey has ensured that the organoleptic and economic qualities of fine whisky have been enhanced over time.

But if once rare whisky was only a distinctive element of belonging to the wealthiest social classes, therefore in a nutshell a status symbol, over time the distillate’s ability to preserve and increase value has been discovered, thanks to the constant reduction of available bottles.

Not only that: the investment in fine whisky collections gave (and still has, ed) the certainty of physically owning the object in which one’s invested money was incorporated, and to make it cash, it was sufficient to put it on the market.

This is what has earned rare whisky its rightful place as a safe haven asset, alongside precious metals, another asset on which families have always tended to allocate a “treasure” for prestige, but also for cases of extreme store of value in the event of wars or serious financial and monetary events.

Rare whisky, today

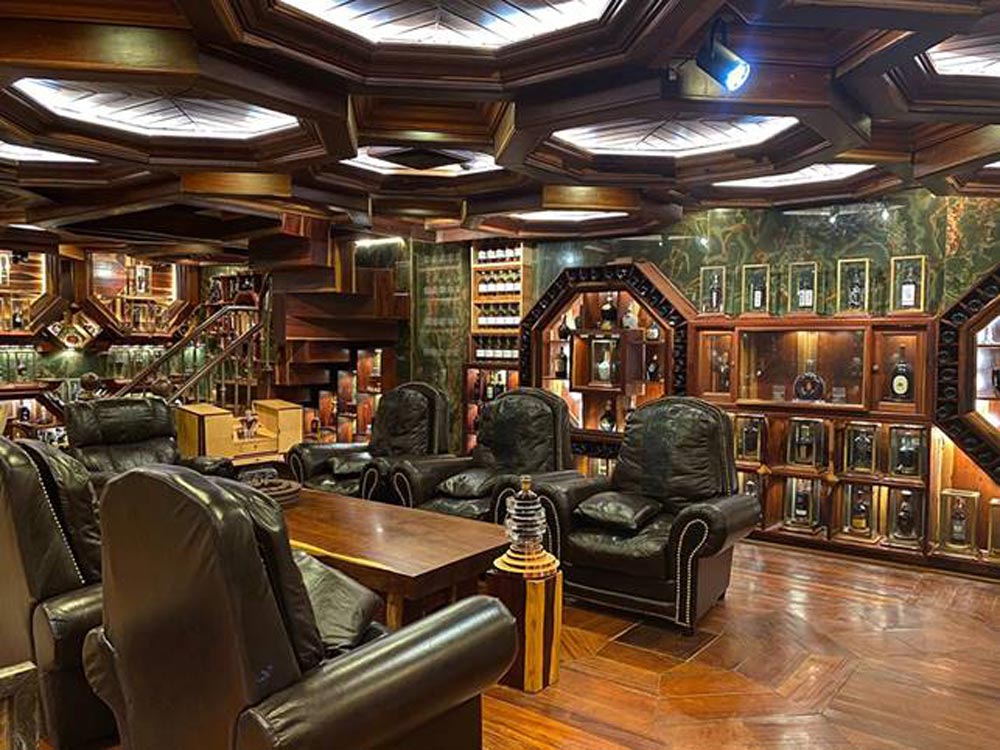

It is curious how a product of such ancient origins is becoming a benchmark among the most uncorrelated investments in the financial market, precisely in an era of cryptocurrencies, NFTs, and a series of new efforts to create investment instruments not linked to geopolitical events or indeed, very often, with market contrarian behavior: The more traditional assets (bonds, equities, currencies) depreciate, the more the “safe-haven” ones maintain and increase their value and appeal. As we have already anticipated in the previous paragraph, the peculiarity of the ownership of the asset makes bottles of fine spirits an absolutely armored and safe investment. So sure that the operation of profit creation translates, materially, into a real sale. No trading platforms with robotic operators or, when human, often opaque in conduct and operation; No intermediation of banking institutions with double purposes. Just the ability to buy well and resell just as well. Paradoxically, nowadays there are more and more investment companies that have allocated substantial funds to collections of rare spirits, which increases the “market hunger” for the rarest and most exclusive bottles, which thus become even less available and, therefore, more expensive. Like any investment, it is necessary to have knowledge of the most sought-after labels and distilleries, to know the entry (purchase) and exit (resale or liquidation) times of your collections, and it is for this reason that The Spirits Club offers its investor clients its own organization and the qualification of its portfolio managers.

Simple private collections or invested assets? A collection of rare spirits represents a real safe haven asset today more than ever, as today is an era in which economic value flows in an extremely liquid way, so much so that it is sometimes elusive. The only way to do this is, therefore, to incorporate it into a precious and coveted physical asset.

We are living in a phase of rampant growth in the demand for fine whiskey bottles, and this is also and above all due to the interest on the part of countries previously unrelated to this asset (although the historical roots of distillation take us to these lands, since 7000 BC), such as India and China, which together have now exceeded the need for rare spirits in the United States of America. It has always been the largest market in terms of turnover for collectible whiskies. The more the demand for bottles of rare spirits increases, the more the prices of such bottles will grow. There are no elements that can allow a reversal of the trend, since the price of a given good can only fall if the availability of the good itself on the market increases, and the main prerogative of fine whisky is, precisely, its rarity. And this is enough to put a definitive seal on the drop in the prices of these real investment tools, as well as cult assets for enthusiasts.

Why invest with The Spirits Club?

Our expertise is to identify the labels suitable for investment purposes and capable of generating profits above the market average.

- Investment in rare and prestigious bottles worldwide

- High experience in the search and availability of bottles

- Product and management transparency

- Exclusive ownership of the investor

- Pool of experts at the top of world collecting in spirits

- Portfolio managers experienced in the management of luxury assets

- Ongoing advisory approach to investors

- Indication of the best moment of liquidation of the product

- Possibility to liquidate at any time in case of need.