The high volatility of traditional markets, combined with their unpredictability of performance, has pushed large numbers of international investors to increasingly diversify their portfolio into luxury assets.

Some distillates have generated a profit of 400% in just five years

Among the latter, investments in fine spirits are certainly distinguished, both for their high performance and for the consolidated market stability, as well as for the very low availability of these labels worldwide.

With a history of performance that is around 30% of average annual return, investment in spirits is becoming more and more, one of the most sought-after forms of financial diversification, not only for primary reasons of protection and preservation of one’s capital, but also and above all for the high returns it is able to offer.

According to data from Liv-Ex, the total trade in distillates in 2022 is already greater than the value of all trade from 2016 to 2020.

Moreover, the previous pandemic situation has done nothing but significantly accelerate the investment in fine distillates and what is expected for the future, can only be a continuous upward trend.

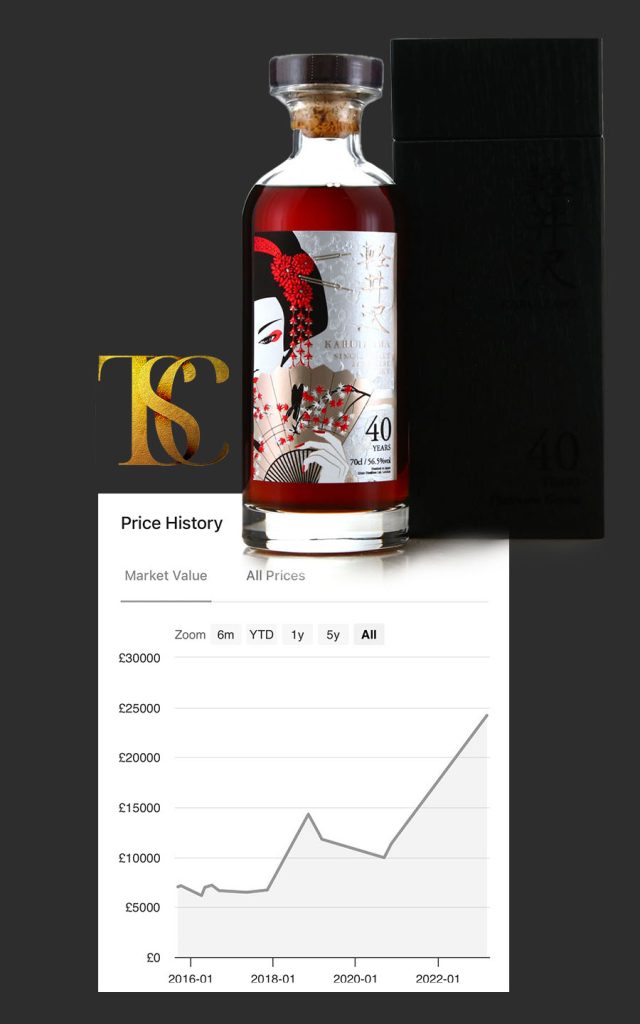

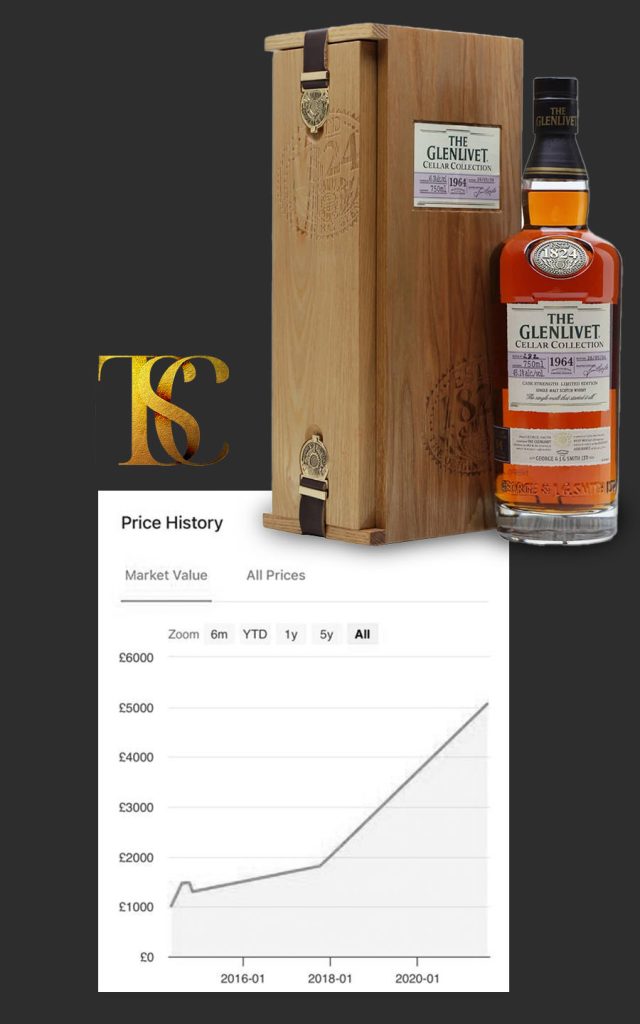

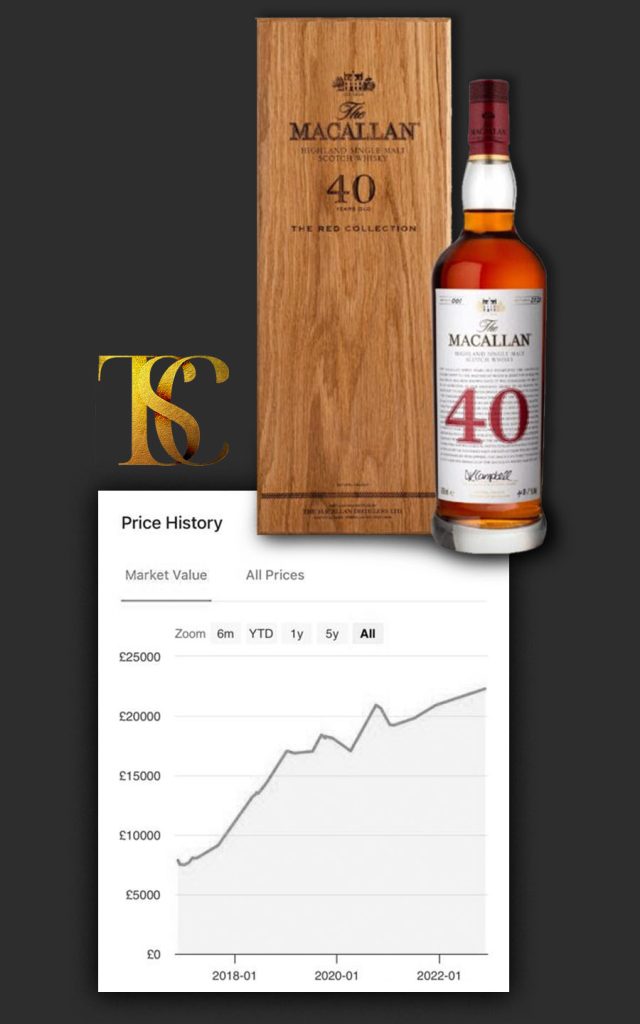

According to the Whisky highland investment grade scotch index, the historical data of whisky investment is excellent. In fact, some distillates have generated a profit of 400% in just five years. Unlike gold which in the same period has only increased by 53%.

The high increase in value is mainly due to the increase in demand, thanks to the increasingly insatiable thirst of the Asian market, linked above all to the birth of small distilleries all over the world; it is no coincidence that a solution considered by many investors has been to focus on spirits of emerging distilleries.

In addition to the great classics Macallan and Ardbeg, new products of emerging distilleries from various countries such as Japan and Ireland are finding an increasingly high approval from investors around the world, with an offer of the same that becomes increasingly scarce.

Investing in whisky, it is more convenient than gold and oil

Investire Oggi

Investment whiskey, a bottle can be worth more than a million

Il Sole 24 Ore

Whisky, a new safe haven to invest in

Panorama

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-advertisement | 1 year | Set by the GDPR Cookie Consent plugin, this cookie records the user consent for the cookies in the "Advertisement" category. |

| cookielawinfo-checkbox-analytics | 1 year | Set by the GDPR Cookie Consent plugin, this cookie is used to record the user consent for the cookies in the "Analytics" category . |

| cookielawinfo-checkbox-functional | 1 year | The GDPR Cookie Consent plugin sets the cookie to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 1 year | Set by the GDPR Cookie Consent plugin, this cookie is used to record the user consent for the cookies in the "Necessary" category . |

| cookielawinfo-checkbox-others | 1 year | Set by the GDPR Cookie Consent plugin, this cookie stores user consent for cookies in the category "Others". |

| CookieLawInfoConsent | 1 year | Records the default button state of the corresponding category & the status of CCPA. It works only in coordination with the primary cookie. |

| elementor | never | This cookie is used by the website's WordPress theme. It allows the website owner to implement or change the website's content in real-time. |

| viewed_cookie_policy | 1 year | The GDPR Cookie Consent plugin sets the cookie to store whether or not the user has consented to use cookies. It does not store any personal data. |

| wp-wpml_current_language | session | WordPress multilingual plugin sets this cookie to store the current language/language settings. |

| Cookie | Duration | Description |

|---|---|---|

| _fbp | 3 months | Facebook sets this cookie to display advertisements when either on Facebook or on a digital platform powered by Facebook advertising after visiting the website. |

| _ga | 1 year 1 month 4 days | Google Analytics sets this cookie to calculate visitor, session and campaign data and track site usage for the site's analytics report. The cookie stores information anonymously and assigns a randomly generated number to recognise unique visitors. |

| _ga_* | 1 year 1 month 4 days | Google Analytics sets this cookie to store and count page views. |

| CONSENT | 2 years | YouTube sets this cookie via embedded YouTube videos and registers anonymous statistical data. |

| Cookie | Duration | Description |

|---|---|---|

| VISITOR_INFO1_LIVE | 5 months 27 days | YouTube sets this cookie to measure bandwidth, determining whether the user gets the new or old player interface. |

| VISITOR_PRIVACY_METADATA | 5 months 27 days | Description is currently not available. |

| YSC | session | Youtube sets this cookie to track the views of embedded videos on Youtube pages. |

| yt-remote-connected-devices | never | YouTube sets this cookie to store the user's video preferences using embedded YouTube videos. |

| yt-remote-device-id | never | YouTube sets this cookie to store the user's video preferences using embedded YouTube videos. |

| yt.innertube::nextId | never | YouTube sets this cookie to register a unique ID to store data on what videos from YouTube the user has seen. |

| yt.innertube::requests | never | YouTube sets this cookie to register a unique ID to store data on what videos from YouTube the user has seen. |