Komoro represents the rebirth of the historic Karuizawa distillery: it opened its doors in July 2023 and the first releases are expected by the end of 2025 which, we are sure, will unleash furore among enthusiasts.

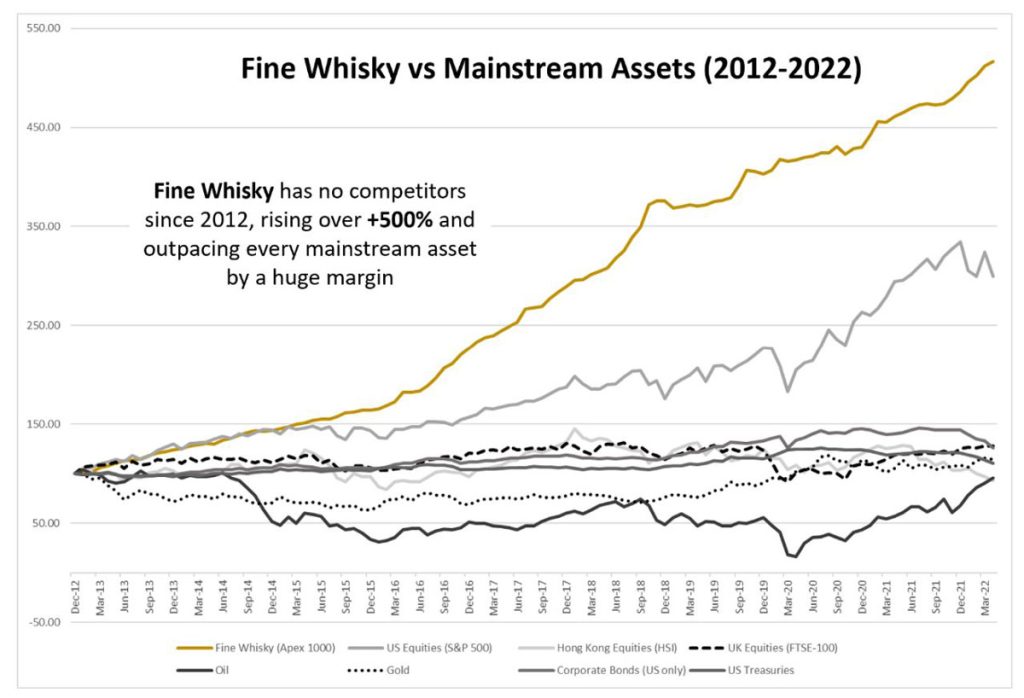

Investing in whisky has become incredibly popular in recent years, as well as a shared interest both by private enthusiasts and connoisseurs, as well as by banks, financial institutions and investment funds. This interest, which has arisen in unison from several fronts, contributes to the seamless enhancement of a tangible asset that now stands at the top of the returns of the most reliable and notoriously best-performing financial sectors ever.

“Unlike stocks or bonds, whiskey offers a tangible investment opportunity, so if you’re looking to diversify your portfolio in 2024, this could be the perfect way to do it. While many whisky collectors begin their journey solely out of their passion and appreciation for this fine spirit, there is no denying that there is a financial benefit to those looking to grow their wealth over time and, whisky, over the years, has proven to be a worthwhile investment.”

This is what was stated by Luxury Lifestyle Magazine, at the forefront of information and management of personal finances, collectibles to be considered for the valid diversification of one’s portfolio, analysis and insights into market changes.

The magazine, and not the only one for that matter, is unbalanced on the increase in value that bottles of fine whiskey undergo, stating that “Whiskey collecting, particularly among the wealthy, has enjoyed a steady surge in popularity in recent years. One of the main reasons for its rise is the sense of exclusivity that comes with getting your hands on rare and limited edition versions, with scarcity ensuring that each one becomes even more sought after.”

Figure 2: Comparison of the best-performing assets of the last ten years. Rare whisky outperforms any commodity and financial index – Source: Cru World Online

The crucial aspect of an investment of this type is therefore in knowing how to calibrate the choice of collections to be purchased and, above all, knowing how to recognize which labels are able to give us important returns in the future, compared to the excellent excellences that are only to be tasted.

But the appeal of stockpiling rare and precious whiskies goes beyond just consumption, says Luxury Lifestyle Magazine. “It is an art form, an investment and a reflection of one’s discerning taste. Many bottles, in fact, are considered so rare and precious that they are never opened or tasted, carefully kept hidden for years while their value continues to rise”.

“It’s also important to note that packaging can play a big role in the value of a whiskey, with pristine bottles and boxes in pristine condition almost invariably driving up the price.”

The preservation of the bottle in its condition of authenticity is in fact one of the most important factors that greatly affects the increase in value of a collector’s bottle. On this topic, we refer to our blog article, which can be consulted at the following link: https://www.yourspiritsclub.com/quanto-conta-autenticita-bottiglie/

Thinking that it is enough to keep an authentic bottle of a certain prestige in your home for it to increase in value is a mistake not to be made. Any self-respecting collector’s item deserves adequate conservation if it is to be recognized for its full value in the future.

The well-known magazine goes on to state that “the value of rare whiskies tends to appreciate over time, often surpassing traditional avenues of investment, and as demand continues to grow, particularly from emerging markets, the scarcity of some bottles will almost certainly mean that they will become considerably more valuable than they are now in the years to come”.

The trend in the prices of fine whiskies

“The scarcity of a whisky greatly influences its desirability and, in turn, its price, which means that getting your hands on one and holding it for the long haul could see it accumulate considerable value over time.”

It is not enough, therefore, that it is simply whiskey. To make an excellent investment, as only bottles of fine spirits can do, you need to know how to choose the bottle you buy and the historical period in which you buy it. In fact, buying an impeccable bottle of value in a given period can generate greater profits than buying it at another historical moment.

As Luxury Lifestyle Magazine puts it, “anticipating the potential appreciation of the value of editions or recognizing when a whisky has reached its maximum maturity will also help you ensure success” and, therefore, make the best profit from its purchase!

The magazine continues, “Knowing what you’re looking for is half the battle, but finding them is often the most difficult task, even for seasoned collectors.”

And it is precisely in research, in the constant and meticulous selection of collections and in the iron knowledge of the reference market that The Spirits Club plays its most important role.

The ability to recognize the bottles in which to invest, as well as their profitability of whiskies, this time Japanese, is also expressed by the largest international news agency Bloomberg.

Asahi Group, a multinational company that produces the Nikka brand, said it is increasing the prices of its spirits by up to 62%, as this is necessary in order to maintain quality and stable supply. Each whiskey has different ingredients and therefore different cost components.

Figure 3: Nikka will increase the list prices of the Taketsuru series by 56%, to maintain the high quality of this premium Pure Malt series, in the face of ever-increasing demand.

A bottle of Nikka that is 10 years old will retail for 50% more. Taketsuru, Nikka’s premium blend, will experience a 56% increase.

The biggest jump in price comes for the Yoichi and Miyagikyo versions, which will be sold with a 62% price increase.

For its part, Suntory, Asahi’s biggest competitor in the field of premium whiskey, announced last month that it will double the price of its most symbolic expressions such as 30-year-old Hibiki and 25-year-old Yahazaki.

In a context of growing demand for fine whiskies for investment purposes, despite the global economic and geopolitical situation at times uncertain and worrying, the interpretation that we at The Spirits Club have been repeating since the beginning of our adventure in the world of investments in rare spirits is encouraging: the world of investors has seen fine whiskey as a safe asset, performance and not conditioned by the exogenous factors typical of “intangible” financial markets. The time to enter this sector could not be better, given the predisposition of prestigious distilleries that produce whisky with the characteristics of an investment asset, to increase the prices for the next few years of new productions. Grabbing pieces at a good price for one’s collections will be today’s bet, for tomorrow’s profits.

Why invest with The Spirits Club?

Our expertise is to identify the labels suitable for investment purposes and capable of generating profits above the market average.

- Investment in rare and prestigious bottles worldwide

- High experience in the search and availability of bottles

- Product and management transparency

- Exclusive ownership of the investor

- Pool of experts at the top of world collecting in spirits

- Portfolio managers experienced in the management of luxury assets

- Ongoing advisory approach to investors

- Indication of the best moment of liquidation of the product

- Possibility to liquidate at any time in case of need.