The returns of fine whisky in the past

How much whisky has performed over the past decade

“Ambra in the glass, nectar in the mouth and gold in the pocket“.

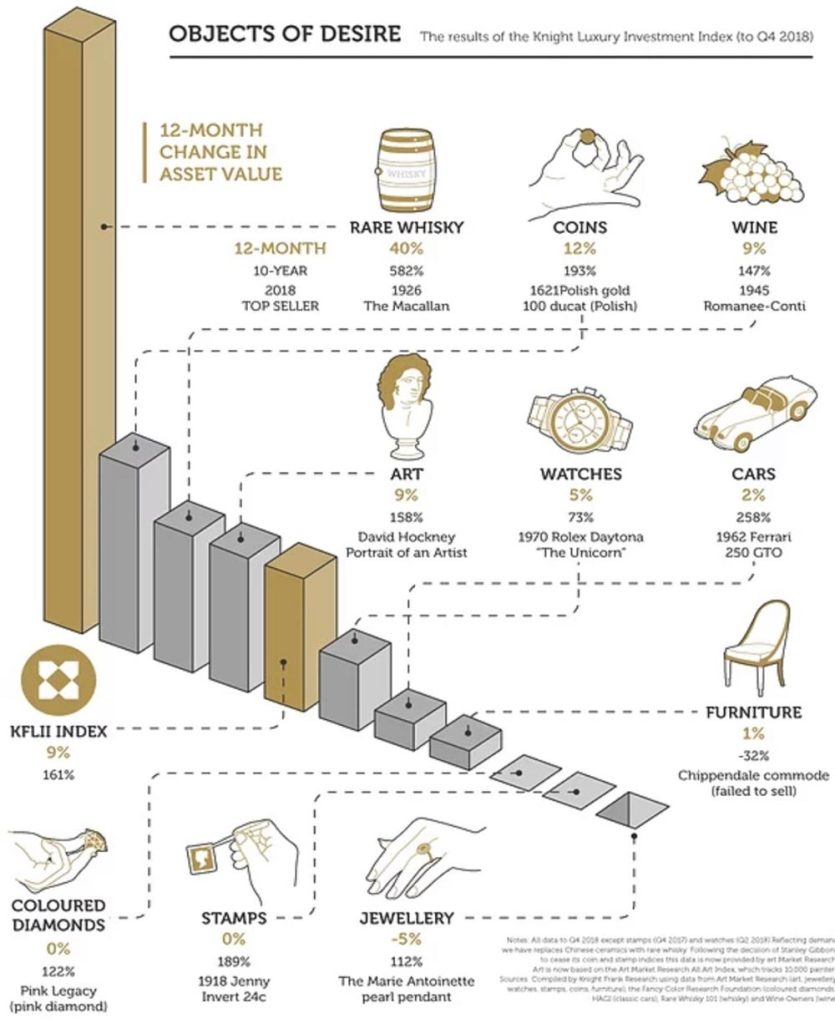

IlSole24ORE begins with this statement, defining rare whiskey as the best performing alternative assets, in first place above all other alternative investments.

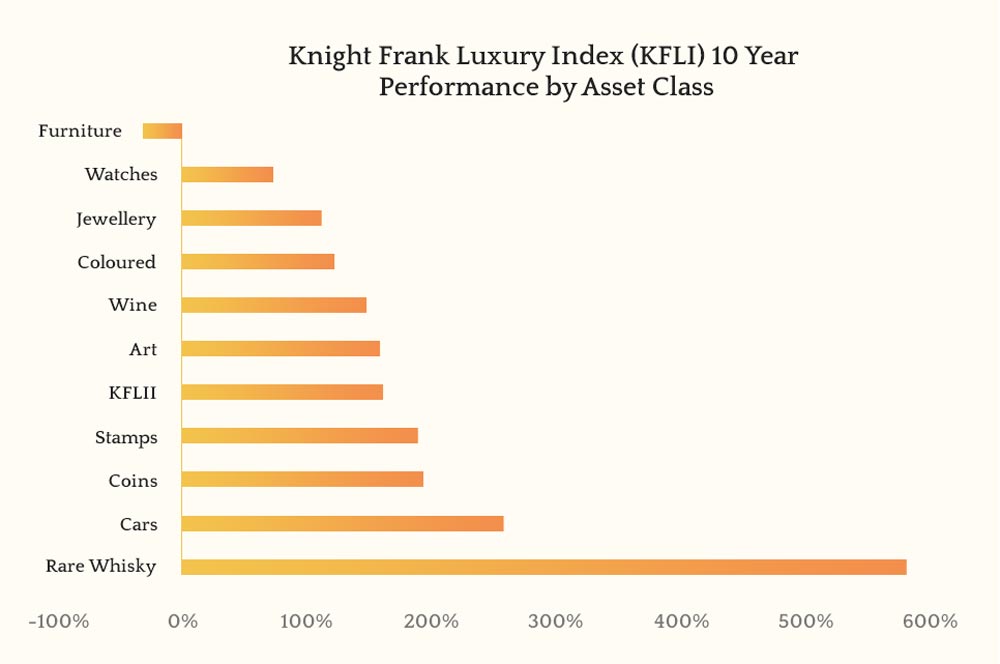

The Knight Frank, in its Luxury Investment Index positions rare whiskey as the most profitable investment ever, thanks to its high performances. Let’s dig deeper into whiskey profits and returns.

Only in the last decade whiskey profits and performances have achieved +563% and some single malts +6 00%, literally pulverizing +12% of coins, +9% of art, +4% of gold and +9% of wine.

The wealthiest investors in the world and looking for a safe haven asset in which to invest safely, have found in rare whisky not only a maximum protection asset of their invested capital, but also a high-performance asset, thanks to a demand for the product of the market that is constantly growing from year to year.

The Asian, American and recently expanded Indian market are confirmed as unsatiable areas of fine whiskey collections, collecting it and then reselling it in the market at dizzying figures of whiskey profits.

The unstoppable increase in demand has led even the great giants of the global market to invest in the creation of new distilleries or in the takeover of previously abandoned distilleries.

This is the case of Diageo, a company founded in 1997 and whose shares have been traded on the London Stock Exchange since 1997, a global leader in beverage and Scotch Whisky, has approved investments of more than one billion pounds for the production of Scotch whisky in the coming years.

To respond to the incessant demand for whisky at a global level, this economic giant, already currently managing 28 malt distilleries representing almost a third of the total capacity of the reference market, has decided to invest further in whisky production, expanding further.

But that’s not just the case with Diageo.

Campari Group, one of the most important players in spirits worldwide, owner of over 50 spirits brands, has recently completed a transaction for the acquisition of Wilderness Trail Distillery, an artisan distillery producing bourbon and rye whisky of the highest quality.

Whiskey profits in the future

What performance is expected in the next decade in whiskey profits

In a global scenario in which inflation, the rise in commodity prices, pandemics not yet completely overcome and the threat of war between states, there is a market niche still unknown to many, in which there is no crisis.

It is the market of fine spirits.

A typical characteristic of the collectible spirits market is that it is not affected by any influence of the financial markets, being completely dissociated from them.

There is therefore no volatility or exogenous event that can affect the increase in value of these iconic collector’s items.

A growth scenario that of rare whiskies, which does not stop stopping, instead envisaging ever higher growth forecasts.

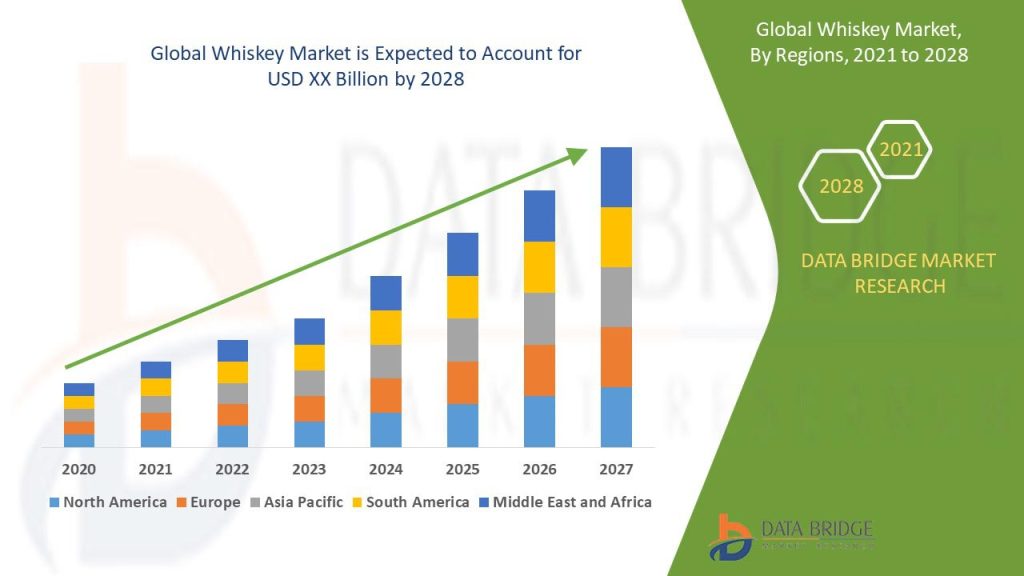

According to the forecasts of the Allied Market Research contained in the Malt Whisky Market by Type report, the global whisky market estimated at 4.3 billion dollars for 2021, will grow in the coming years following a compound annual growth rate (CAGR) of 4.7%, reaching the value of 6.7 billion dollars in 2031.

It is not only existing markets that are buying more whisky.

Added to these are the new emerging markets such as India and China, which have already prepared the opening of whisky distilleries on site to meet their domestic demand, to make room for increasing consumption.

The whiskey profits of our portfolios in fine spirits investments

The average annual performance of our portfolios in fine spirits

In the last decade alone, rare whiskies have performed +582%, literally beating all other alternative investments.

But this performance is also expected for the next decade, if not to a greater extent, given the increase in demand for these iconic pieces, as well as the opening of new emerging markets.

To get a more concrete idea of the profit that fine distillates are able to generate, just consider that the average performance of our Portfolios is around 25-30% per year.

It will be enough to keep the collections for a few years, and then resell them in the years to come, at a significantly higher profit.

And considering that there is no value added tax both on the purchase and resale of the collections, just as there is no taxation on capital gains at the time of sale of the same, it is the investment chosen by the most careful and scrupulous investors, but also by important collectors.

Why invest with The Spirits Club?

Our expertise is to identify the labels suitable for investment purposes and capable of generating profits above the market average.

- Investment in rare and prestigious bottles worldwide

- High experience in the search and availability of bottles

- Product and management transparency

- Exclusive ownership of the investor

- Pool of experts at the top of world collecting in spirits

- Portfolio managers experienced in the management of luxury assets

- Ongoing advisory approach to investors

- Indication of the best moment of liquidation of the product

- Possibility to liquidate at any time in case of need.

Want to learn more? Download our free spirits investment guide.