We have repeated enumerated the reasons why a bottle of Scotch whiskey can be a real asset to invest in but, for the benefit of those who missed the previous publications, we summarize them below:

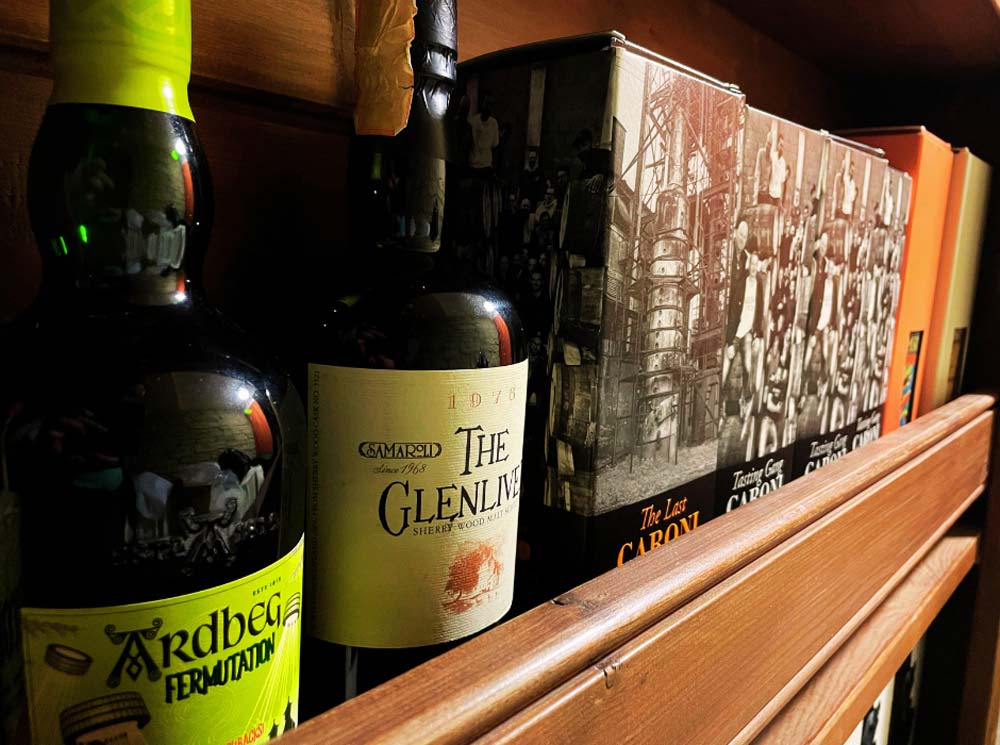

1. Increase in value over time: Certain whiskies, especially those from limited editions or closed distilleries, can increase in value over the years. This is especially true if the whisky becomes rare or highly sought after by collectors.

2. Collecting: For many people, collecting whisky can be a point of pride and personal satisfaction. With his continuous search for pieces to add to his collection, the collector “subtracts” bottles of fine spirits from the market and this further increases the prices of investment-grade bottles available for sale;

3. Investment diversification: For investors, whisky can be an alternative form of investment to diversify their portfolio. Investors see whisky as a store of value similar to gold or other commodities.

4. Passion and self-interest: Many people invest in whisky not only because of the potential for profit, but also because they love the history, production, and taste of whisky. Buying rare bottles of whisky can be a source of personal joy as well as a profitable investment.

5. High demand: As global interest in whisky increases, especially in emerging markets such as Asia, the demand for high-quality, limited-edition whiskies is steadily growing, which inexorably and relentlessly increases the value of bottles over time.

Spirits Investment: which ones to choose; Scotch Whiskey or Rum?

The dynamics of prices and the persistent shortage of fine bottles that manifests itself among whiskies, can also be experienced in other kinds of spirits, such as some rums, for several reasons:

These, for example, are produced in limited editions or from closed distilleries, making them particularly sought after by collectors. The rarity of certain bottles inevitably increases their value over time: like whisky, some high-quality rums can increase in value over the years, especially if they are kept in optimal storage conditions.

Additionally, rum can have a fascinating history related to its production and its provenance from specific regions such as the Caribbean. Bottles with an interesting history or from historic distilleries can have added value for collectors.

Chichibu 7Even Gods of Fortune Bishamonten è una bottiglia prodotta in soli 211 pezzi. La qualità del distillato, il valore rappresentato dall’esclusivo packaging e dall’aura mitologica che abbraccia l’intera storia giapponese, ne fanno un pezzo da collezione e da investimento con ritorni importanti.

In addition, as already seen for fine whiskies, the interest of collectors also has a great impact among rums: the world of rum is constantly growing, with an increasing number of enthusiasts and collectors looking for rare and unique bottles. Demand from this market can affect the value of the desired bottles. A collector is able to attribute a considerably higher value, than any professional in the trade of alcoholic products, to a specific label, because he knows its history, the background connected to it, as well as the state of conservation of the specific bottle. Today, as never before in any other economic era, everything is a “market”, and a bottle auctioned or purchased at an exorbitant price, creates an indelible precedent that will feed the springboard of the value of that label.

However, this is what we would like to convey most to the reader of this article: those who buy bottles of rare whisky, rum or cognac, also do so with a view to diversifying their investment portfolio. Although less common than whisky as a form of investment, rum can offer similar opportunities for those looking to expand their investment options.

Time, dedication and historical culture of Scotch Whiskey and other Spirits

The constant increase in the prices of rare whiskies can be summarised in the following points:

1. Time and resources: the process of aging whisky takes time and resources. During the aging period, the whisky slowly absorbs the characteristics of the wood of the barrel, thus developing complexity of aromas and flavors. This process takes years, sometimes decades, during which time the whisky is stored and monitored, increasing production costs.

2. Evaporation: during aging, a portion of the whisky evaporates, known as the “angels’ share.” This means that, over time, there is a quantitative reduction in the product available, which contributes to an increase in the cost per bottle.

3. Scarcity: whisky bottles that have been aged for long periods become increasingly rare as time goes on, because people love to drink them. As demand for these fine whiskies often exceeds supply, prices rise accordingly.

4. Quality: in general, whisky aged for longer periods tends to be of higher quality, thanks to the time spent in cask to develop complexity and depth of flavor. This increase in quality contributes to the higher cost.

5. Exclusivity and prestige: the most aged whiskies often come from limited batches or special editions, making them even more exclusive and desirable for collectors and connoisseurs.

Questo stabilimento fantasma è lo scrigno nel quale per 83 anni sono nati i rum di prestigio più ambiti al mondo: Caroni oggi è considerato il nome più altisonante tra i rum da investimento.

If Scotch whiskey is considered the alcoholic investment par excellence, we have nevertheless been able to ascertain that other types of spirits also offer this opportunity, as is the case, precisely, for some cognacs, rums and bourbons.

Owning a collection of fine spirits can be a symbol of social status for some people, as it shows a certain level of taste, sophistication, and ability to appreciate exclusive products that incorporate culture, history, and a love of quality. Quality is an almost silent attribute nowadays, because the speed with which we live, produce and even think, distances the individual from the “how” a given product is made, to give space only to the “how much”, to the number of products that can be made in the shortest amount of time. This philosophy of work and life is dramatically distant from the world of spirits, whose fundamental human ingredients are the time dedicated, the care taken in the various stages of distillate production, as well as the passion in conceiving a liquid capable of lasting decades without deteriorating, rather maturing and becoming an ever better version of itself.

How to invest in Scotch Whiskey and fine spirits?

It is important to note that investing in fine spirits should be done with prudence and awareness. Before investing in whisky on your own, it is important to have a thorough understanding of the industry. This includes understanding distilleries, whisky varieties, market trends, and bottle valuation. The Spirits Club was created with the intention of giving even inexperienced investors access to investment in rare spirits, providing them with the skills of a professional team expressly trained in the selection and composition of portfolios based on the profit objectives of each client.

Furthermore, the preservation of the collections is a crucial factor that greatly affects the increase in value of the same, and therefore directly on the profits expected at the time of liquidation. This is why The Spirits Club keeps its customers’ collections in tax warehouses protected from weather, vandalism or otherwise harmful to their integrity, as well as insured, so that their value is not exposed to any risk profile.

Why invest with The Spirits Club?

Our expertise is to identify the labels suitable for investment purposes and capable of generating profits above the market average.

- Investment in rare and prestigious bottles worldwide

- High experience in the search and availability of bottles

- Product and management transparency

- Exclusive ownership of the investor

- Pool of experts at the top of world collecting in spirits

- Portfolio managers experienced in the management of luxury assets

- Ongoing advisory approach to investors

- Indication of the best moment of liquidation of the product

- Possibility to liquidate at any time in case of need.