Yamazaki 55 Year Old, one of the spearheads of the investment in rare whiskies. This jewel of the Yamazaki house is considered a safe haven asset and an asset capable of multiplying its value like few others.

The liquidation of fine spirits bottles representatives the crowning achievement of an investment path made up of careful choice of collections, patience, meticulous study of the price trend of each individual label and, of course, knowing how to size the right moment to liquidate and maximize what in financial jargon is called “gain”, or profit. In fact, liquidation is the most important moment of the whole investment, since it reveals to us whether our choice to believe in those bottles for the time that has passed has really been a winning one.

The management of the collections of fine spirits with a view to medium-term investment, but not only, takes place by relying on companies active in this sector, in order to avoid unnecessary risks of purchase and possession of counterfeit bottles.

The risk of grabbing counterfeit bottles or bottles with damages through a photo on an ad, or simply due to too much trust in the seller at a distance, is bypassed in this way. It is no coincidence that The Spirits Club is equipped not only with capable portfolio managers, but also with experts in whiskies and rare spirits who work for our investors, searching through super-consolidated channels only for the best bottles, which in this way ensure to guarantee the owner of the same a safe value for the future, but also rapid liquidation at a high price.

The sale of bottles of fine spirits, such as whiskey, cognac, rum and others, also takes place through other channels and can involve different methods and regulations depending on the country.

Risks of do-it-yourself buying and selling of fine spirits bottles

Here is an overview of the possible ways of buying and reselling bottles of fine spirits on their own:

In the case of specialized shops (wine shops and liquor stores), many shops dedicated to the sale of high quality spirits offer a selection of fine spirits, but in this sector there is never advice on the purchase and resale of bottles. As these activities are merchants who earn from the sale at the highest price, so they do not exactly serve the interests of the investor, who instead aspires to maximize profit.

An example of a careless purchase (by a hotel, sigh!): the famous Macallan 1878, which turned out to be a blatant fake. Served in a Swiss hotel to the unfortunate Chinese tourist who wanted to live the experience of sipping a distillate of almost 150 years, at the modest sum of £ 8,000 per shot.

As far as online sales are concerned, there are e-commerce sites that take care of, among other product categories, the sale of whiskey, rum and spirits of a certain value in general: there are many websites specialized in the sale of alcohol, as well as online auction houses that organize auctions where you can buy rare and precious bottles. The problem that arises here is the transparency and honesty of the seller, who uses these platforms to sell his collections to the highest bidder: no one protects us from bad surprises and the only meagre consolation we will have, once the bottle is received, will be to give negative feedback. But, in the meantime, he’ll have to drink that bottle, to forget about the bad deal!

As for other do-it-yourself channels that allow access to bottles of fine spirits, it is worth mentioning traditional auctions, or in presence. Large auction houses such as Christie’s and Sotheby’s hold in-person auctions where rare, high-quality spirits are sold. Here, too, a high-level background is needed to understand the difference in value between several series of the same label, the incidence in the price decrease of certain imperfections on the bottle or packaging, and a place to store them without them deteriorating, once they have been hoarded. In short, it is not a pleasant pastime to buy bottles that can exceed even ten thousand euros in value each.

Some distilleries organize direct sales to the public at specific moments of their production cycle or about to launch a new collection or series, sales most often reserved only for people who take part in a guided tour of the distillery itself. We also consider access to these direct sales as a kind of “coupon” or reward for paying at the time of the visit.

In relation to the so-called secondary market (purchase from private collectors), the same considerations apply as for online auctions and spirits shops: collectors can sell their fine bottles to other enthusiasts via specialized platforms or forums. The problem with this method of buying and selling is the certainty about the “state of health” of the bottles, about their origin and not counterfeiting. Cases of counterfeiting of bottles of prestigious brands are rare, but unfortunately famous: think of the Macallan of 1878… fake, which happened to be in the hands of a Chinese tourist, an event that sparked the hunt and the discovery of about a thousand bottles branded Macallan but in fact created using blends of commercial spirits and faithfully reproducing the labels, even going so far as to “antiquize” the cap and seals of the state monopoly. Here, these specimens of illustrious fakes are put into circulation by gangs of counterfeiters who pollute the market, betraying the trust of private buyers convinced that they are buying (and then reselling, of course) rare pieces of high value, at sale prices.

Not only that, but the high costs of commissions that exist in auction houses are also often ignored and which, at the end of the day, have a significant impact.

The importance of the consultant specialized in rare spirits

Nowadays, thanks to the surge in demand for rare investment whiskies, combined with the inexorable contingent “rarification” of bottles, a network of agents or intermediaries specialized in the purchase and sale of luxury spirits for investment purposes for their customers is being structured and consolidated. These figures facilitate first of all the purchase at the best price, they also facilitate the prompt liquidation of the collections, in exchange for a small commission or fee, which will remain in the hands of the intermediary himself. This fee will be used to pay for your vault in the tax warehouse, where your bottles are stored at controlled temperature and humidity, under strict surveillance and in compliance with safety devices that become increasingly stringent based on the economic entity of the collection.

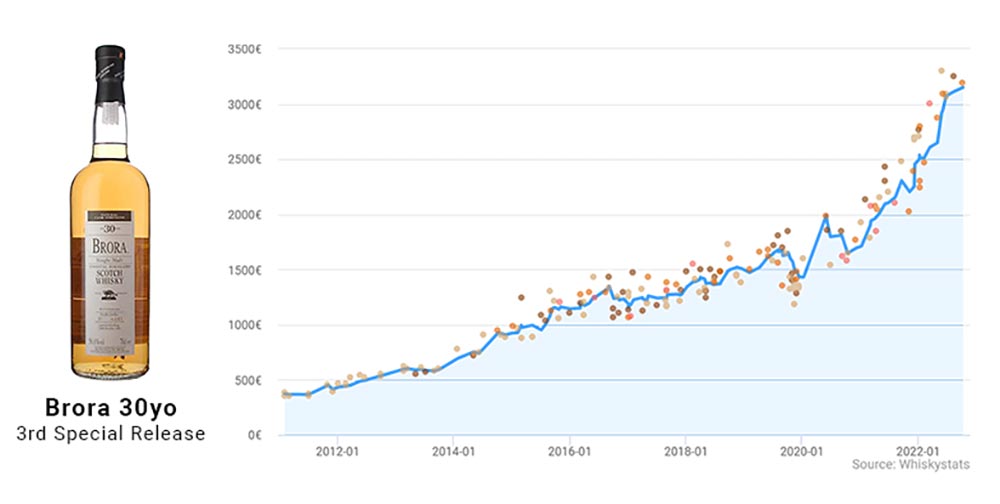

The Brora 30YO, 3rd Special Release by Diageo is a clear example of a continuous and disruptive increase in value: from an introductory price of around 400 Euros, it has reached the latest recorded (and not yet updated) sales value of 3200 Euros. It is curious to note that, even if we narrowed the time frame to the last two years (i.e., purchase 2020, sale 2022) we would still have made a profit of about 135%.

A company specializing in investments in high-quality spirits is able to guarantee the widest range between purchase price and liquidation price, maximizing profit for the customer. In addition, The Spirits Club provides suggestions on the right times to increase certain positions, or to partially or totally liquidate some of them, to reinvest them or to take profit, according to the request and needs of the investor client.

In conclusion, the buying and selling, and even more so the liquidation of bottles of fine spirits, involve a combination of traditional and modern channels, each with its own peculiarities and regulations. The important thing is to be aware that those who work professionally in the sector are able to keep you away from the emotionality of the moment, which can cause easy purchases at too high prices, the certainty of originality of the pieces added to your collection, and the maximization of profit.

Why invest with The Spirits Club?

Our expertise is to identify the labels suitable for investment purposes and capable of generating profits above the market average.

- Investment in rare and prestigious bottles worldwide

- High experience in the search and availability of bottles

- Product and management transparency

- Exclusive ownership of the investor

- Pool of experts at the top of world collecting in spirits

- Portfolio managers experienced in the management of luxury assets

- Ongoing advisory approach to investors

- Indication of the best moment of liquidation of the product

- Possibility to liquidate at any time in case of need.