As a corollary to this article, it should be noted that there is no safer investment than the one which gives, as consideration for the sum committed, a physical asset. However, investing in whiskey can be highly profitable for individuals looking for tangible assets.

Collectible whisky bottles are considered a “safe haven” asset, like metals and precious stones, with the difference that, in the case of collectible whisky bottles, you will physically purchase bottles of your exclusive property, and not derivatives contracts or certificates that have the asset itself as underlying.

The collectible whisky sector is fueled by a small circle of spirits lovers. What these enthusiasts focus on is not only the quality of the spirit itself, but also on the history of the individual distilleries, on the experiencies of the individual barrels from which very few bottles in limited series are made. But the collector’s skills do not stop at the precious liquid: they go further, up to the bottling techniques, to the specific packaging for each individual series of bottles, to the artists who often enrich the value of these bottles by personally designing the labels and creating them, the packaging, producing true works of art.

But the purpose of this article is to educate the investor of traditional assets, who wants to approach investing in fine whisky, on how to do it best, because it is not enough to buy a bottle of primary distilleries and keep it on the noticeboard for a few months to ensure a profit.

1. Recognize the quality of the spirit

As we have already mentioned, there are various qualities of spirits on the whisky market.

We can broadly distinguish 9 macro-categories of whisky:

- Rye Whisky

- Canadian Whisky

- Japanese Whisky

- Bourbon Whisky

- Tennessee Whisky

- Irish Whisky

- Scotch Whisky (although Scotch is in a category of its own)

- Blended Whisky

- Single Malt Whisky

Suffice it to say that, in the Scotch whisky category alone, there are 5 subcategories:

- Single Malt Scotch Whisky

- Single Grain Scotch Whisky

- Blended Scotch Whisky

- Blended Malt Scotch Whisky

- Blended Grain Scotch Whisky

Each of these sub-categories has various nuances of taste and aromas: thirteen characteristics of odors have been catalogued, remaining only in the context of Scotch whisky. Of course, the “investment-grade” connotation of a bottle of whisky is not just a matter of olfactory and tasting qualities, but involves a series of other characteristics that complete the “piece”.

2. Know the circulation of each series when investing in whiskey

For each vintage whisky, there are various selections, produced in very different quantities. The potential for increasing the value of a whisky, with specific regard to the identifying characteristics of each bottle, the specific cask from which the spirit was drawn, the type of wood in which it was constructed, the age of the spirit, the years of maturation in the same cask (if it is a “single cask”) or, otherwise, the references of the casks from which it was drawn to produce and package the distillate; but above all, how many bottles in total were produced and sealed by the House using the distillates from that specific barrel or barrels.

This consists of the tracing, or the DNA, so to speak, of a bottle with collecting and investment potential.

Figure 1: Bowmore 1966 was produced in a total of 43 bottles. The unit cost of each piece today stands at around 70,000 euros

In order to evaluate and “weigh” these specifications financially, it is essential to have a cultural background on the subject or, alternatively, to rely on companies that specifically deal with the management of portfolios of investment whisky bottles, such as The Spirits Club. This last option it is useful for those who, not being experts in the subject, do not want to risk overpaying for bottles which will then be difficult to resell, due to a future decrease in value or because they are not attractive to whisky investors.

3. Evaluate the time horizon of your investment

If you invest in government debt securities (bonds, BTPs, Bunds, etc.) your time objective for liquidating the position is in the medium to long term. If you invest today, therefore, you will most likely prefer to collect the coupon (periodic return) of your government bonds, and liquidate the entire position upon their maturity. Sometimes, however, you will collect a certain number of coupons and sell well before their natural expiration. Investing in whiskey is much more flexible.

This, in the field of investment whisky, does not happen, since the time horizon for realizing profits is very variable, based on the investor’s needs for realization. In the first case, in fact, it is the investor who has to adapt to the asset’s return “style”; vice versa, in the case of collectible whisky, he can choose to compose the collection based on his precise needs for commitment and disengagement of the capital employed.

The time period usually taken into consideration when talking about investment-grade whisky is the short-medium term, i.e. from 6 months to 2 years. This does not mean that the bottles stop producing profits after this time threshold, but that you can earn rich profits after just a few months from the first investment.

Our portfolio managers will be able to put together with you the best price/time/return mix suited to your specific needs: investing in fine whisky is a tailor-made suit for the investor, because it is not standardized, which is true for every asset traditional available on the financial markets.

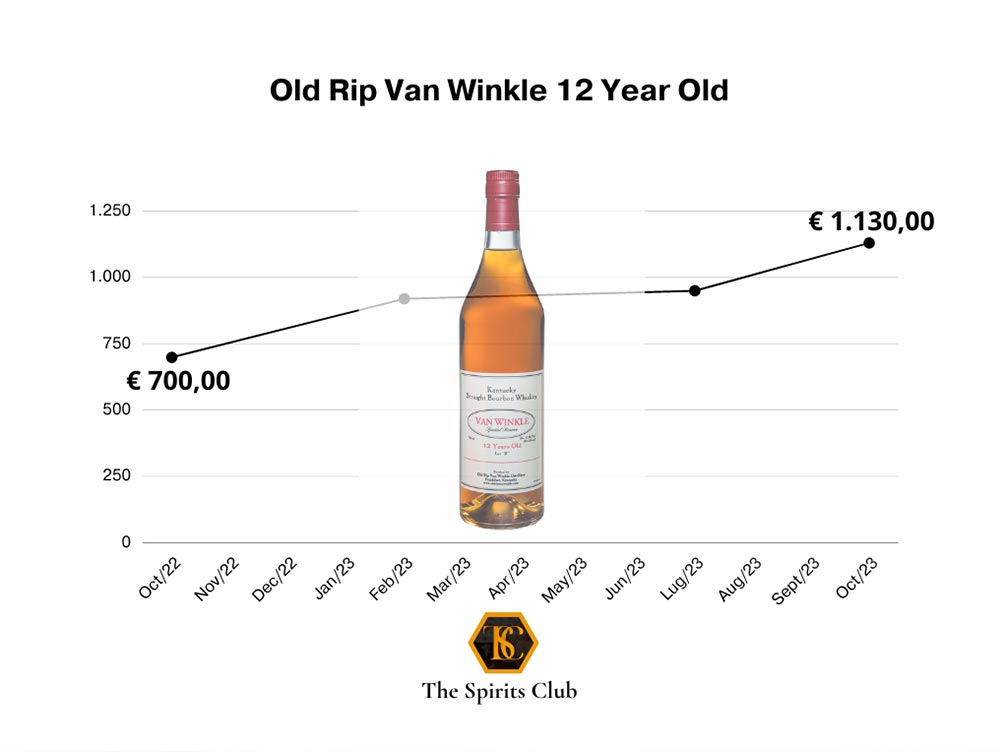

2: Price trend of Old Rip Van Winkle 12 Year Old: in approximately three months it marked an increase of approximately 25%, and then marked a robust +62% after a year.

4. Evaluate the “size” of each position when investing in whiskey

If, in the purchase of a certain number of shares when investing in whiskey, we already know in advance that the overall amount of the invested capital is distributed among a precise number of shares of specific and uniform unit value, in the case of the composition of a collection of whiskey bottles rare, it is good to consider that there are bottles whose carrying price is a few hundred Euros, and others which can cost hundreds of thousands of Euros, or even over a million.

For this reason it is important to regulate the distribution of the total capital invested in bottles of fine whisky based on the total sum to be allocated to the investment itself! If you intend to invest a total sum of 10,000 Euros, it will be inappropriate to purchase a 9,500 Euro bottle and a 500 Euro bottle, since you will have little possibility of partial liquidations or reinvestment of the proceeds of a single position (since there would only be two, ed.), most of the capital being tied up in the most expensive bottle.

To give a better idea of what has been written, here is an example of how the capital should be distributed:

3: Example of an investment strategy on a capital of Euro 5,450: a coherent distribution of capital on positions that can be liquidated individually and possibly reinvested is fundamental.

This is a preliminary guide to investing in fine whiskey, which is not intended to encourage purchase but is intended to be a simple introductory food for thought into the fascinating world of investing in rare collectible bottles of whisky, for whose approach we recommend turn to companies that professionally carry out consultancy and composition of portfolios of fine whiskies on behalf of investor clients, constantly follow them in the performance and in the appropriate moments of liquidation and increase of their collections, and deal with the resale of the bottles subject to liquidation.

The Spirits Club makes its whiskey experts and portfolio managers available: all you have to do is contact us if you intend to invest in rare physical goods with guaranteed evaluation in the short to medium term.

Want to learn more? Download our free spirits investment guide.