Alternative assets and safe investments: what is it?

In particular: alternative investments and safe haven assets

Known as the safe-haven investments par excellence, alternative investments are the preferred investments for all investors who like to see their assets increase over time, steadily and gradually, without bad surprises. Whiskey offers the safe investments with a high return and no surprises.

No changes in value, therefore, caused by market news.

Alternative investments are characterized by their intrinsic quality, which allows them to increase in value over time, even when there is high market uncertainty, when other types of investments would depreciate sharply.

Here, then, is their true meaning: a real ” safe haven” in which to take refuge to better shelter from the turbulence of the markets, whether economic, financial or political.

Not surprisingly, safe havens are chosen by wealthy investors who do not want to put their huge resources at the mercy of the markets, risking finding an investment decimated even in the short term.

Safe haven assets are mainly characterized by three important qualities:

- they are real assets and therefore tangible

- have constant value growth over time

- allow you to diversify your portfolio

Their advantage, therefore, is to have a real value that lasts over time and that increases even in conditions of strong negativity of the markets.

Investing in whisky: why and how does it work?

In particular: how to invest in whiskey

Investing in spirits means buying tangible physical goods that are in fact bottles of spirits and having full ownership of the same.

It is not, therefore, a question of investing in something abstract, not tangible, as if it were a stock exchange, a share, a crypto.

On the contrary, when you invest in collectible spirits it means investing in a physical, material and tangible asset.

An aspect of fundamental importance in this type of investment certainly concerns the conservation of the bottles which, for the purpose of their maturation, must be stored in special structures designed to ensure the optimal maturation process and conservation of the same.

The strength of this investment is that it is not necessary to be an expert in spirits or the relative reference market to invest in it, because it is a service fully managed by our company, which therefore takes care of following the investor from the choice of the bottles until the time of resale of the same in the market with profit.

Investment with a high return: Is the investment in whiskey safe and profitable?

In particular: what are the risks of investing in whisky

There are several safe haven assets, allowing the investor the possibility to differentiate his portfolio.

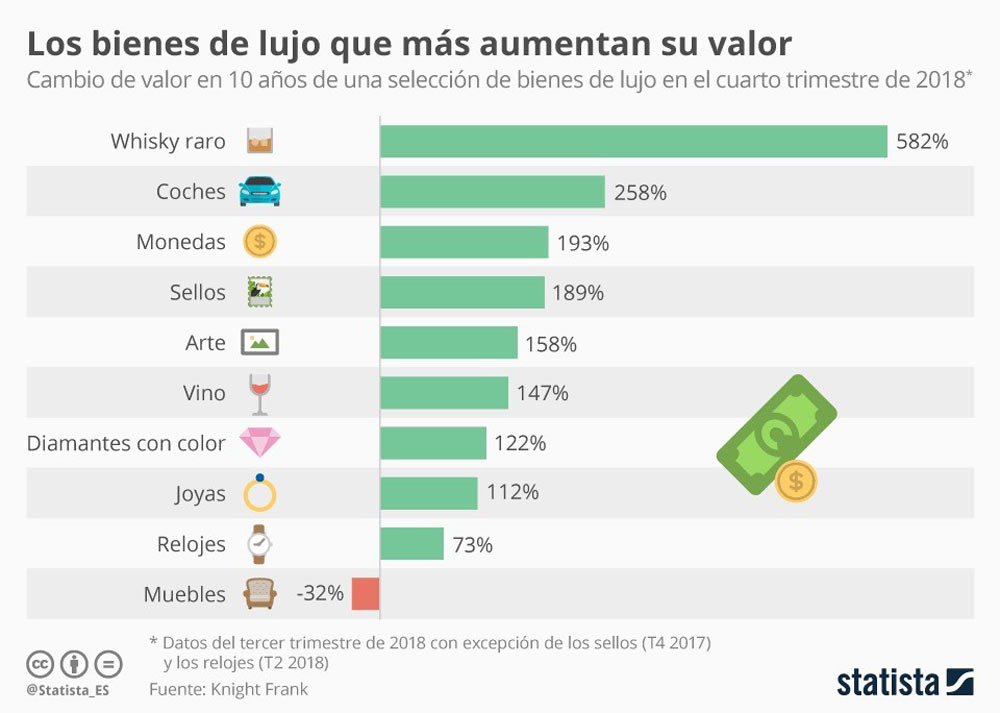

In the beginning, the safe-haven asset par excellence was gold, but with the passing of time also other goods such as cars, bags, jewelry, art, stamps, watches, coins and wine have ended up becoming strategic assets to preserve the value of one’s money, seeing its profits grow at the same time.

According to Bloomberg and the Whisky Highland Investment Grade Scotch Index, a more profitable investment than gold and oil is fine whisky.

Some single malts, in fact, were able to generate a gain of 440% in just 6 years, while gold marked a rise of only 53% (2008-2014). This increase is due to the increase in demand from the insatiable Asian market and the emergence of new micro-distilleries around the world, to the delight and luck of investors.

Among all the alternatives, whisky is the safe-haven asset par excellence that stands out for its high returns around 30% average per year, as well as the object of desire most sought after by collectors.

This is what happened in the last 10 years in which rare whisky has recorded a growth of 582% (source Knight Frank Luxury), thanks to a whisky supply that is always too scarce and insufficient to meet the growing demand for the same, by the market.

Not only that, to request it are more and more collectors and consumers of a younger age and is therefore not only of interest to older generation.

The high figures that characterize the thriving rare whisky industry do not stop at growth estimates.

Looking at the market, for example, the Scotch whiskey industry ships 44 bottles per second to international markets, precisely in more than 180 markets, for a value of 4.5 billion pounds which corresponds to a share of 22% of the entire food and beverage exported each year from the United Kingdom.

Growth of Whiskey: Safe Investments with a High Return

In terms of growth regions, Scotland remains the main stable and favored market, accounting for 20% of the market with an average price increasing by 35%. But among the Scottish regions with somewhat impressive growth, Campbeltown certainly stood out with 82% growth and Lowlands with 41% growth in 2022 alone.

With such significant growth that it is only increasing over the next decade, by 2031 the whisky market will reach an already projected value of around 6.7 billion dollars.

Why invest with The Spirits Club?

Our expertise is to identify the labels suitable for investment purposes and capable of generating profits above the market average.

- Investment in rare and prestigious bottles worldwide

- High experience in the search and availability of bottles

- Product and management transparency

- Exclusive ownership of the investor

- Pool of experts at the top of world collecting in spirits

- Portfolio managers experienced in the management of luxury assets

- Ongoing advisory approach to investors

- Indication of the best moment of liquidation of the product

- Possibility to liquidate at any time in case of need.

If you are looking to build a safe and profitable portfolio, get in touch to find out more.