Investing in rare spirits has become an exciting and profitable venture in recent years. For those looking to diversify their portfolios beyond financial investments, the rare whisky bottles market offers a mix of culture, history, and luxury. But like any investment, entering this space requires research, strategy, and patience. Here’s a beginner’s guide to help you navigate your first steps into the world of spirit investments.

1. Why Invest in Rare Spirits?

Why should you be interested in entering the alternative investment industry? Rare spirits, particularly whisky, have been attracting attention as alternative investments because of their limited availability and historical track record of appreciation in value. Unlike stocks and bonds, rare bottles of whisky, rum, and other spirits are physical assets with tangible value. Many investors are drawn to the world of spirits because it combines passion with profit potential. Here are a few reasons why rare spirits make a compelling investment:

- Cultural Appeal: Whisky, in particular, is steeped in tradition and has an international following, making it a culturally significant and sought-after commodity.

- Scarcity: Rare spirits are often produced in limited batches, which increases their value over time, especially once production ceases.

- Age: Like fine wine, aged spirits tend to increase in value as they mature and become more desirable to collectors.

2. Initial Steps for Getting Started

Research the Market

Your first step should be learning as much as possible about the rare spirits market. Whisky tends to be the most commonly traded asset in this field, but you can also find significant opportunities in certain rum bottles.

Some key points to focus on are:

- Region: Scottish single malt whiskies, for example, are highly prized, but Irish, Japanese, and American whiskies are also sought after.

- Distilleries: Certain distilleries, such as Macallan, Glenfiddich, or Yamazaki, are famous for producing collectible and investment-grade spirits.

- Awards and Rarity: Spirits that have won prestigious awards or have a unique production process tend to be more desirable.

The Budget

Just like any investment, it’s essential to start with a clear budget. Rare spirits can range from a few hundred dollars to tens of thousands, depending on factors like age, rarity, and brand. A good rule of thumb for beginners is to start small—focus on bottles between $500 and $2,000. This will allow you to test the market without taking on too much risk.

Understand the Storage Requirements

Storing your spirits properly is crucial. The value of your investment can decline significantly if a bottle is damaged due to improper handling or environmental factors. Unlike wine, whisky and other spirits don’t improve in the bottle, so your goal is preservation rather than aging. It is useful to remind to refer to specialized companies, like The Spirits Club, because we are equipped with custodial services in controlled environmental conditions and our bonded warehouses are fully insured against damage, natural disasters, wars, and theft.

For the purpose of pure investment, it is therefore highly recommended to store your collections in fiscal warehouses managed by the company that will assist you throughout the entire investment and liquidation process.

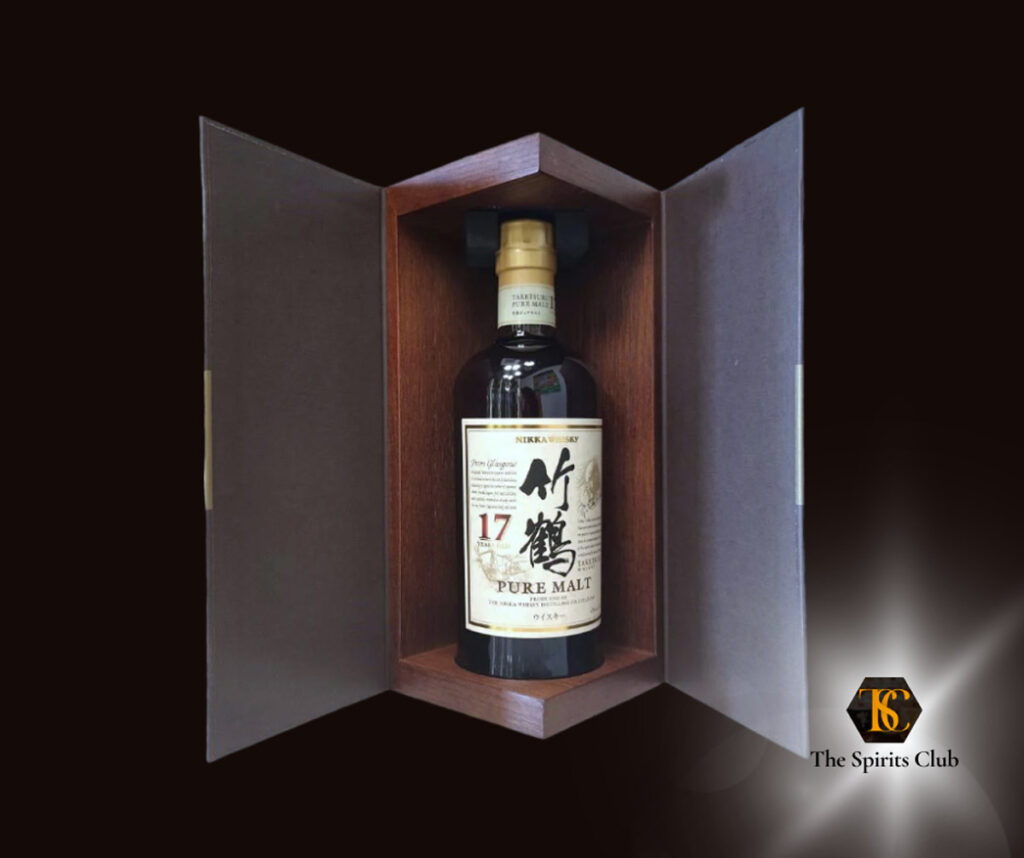

Nikka Taketsuru 17 is often a good choice to start a first collectible whisky bottles portfolio. Make sure about the different releases and packaging and, obviously, about the price you purchase it.

Diversify Your Collection

As with any investment portfolio, diversification is key. Rather than putting all your money into a single bottle or brand, your T.S.C. personal portfolio manager will spread your investments across different distilleries, regions, and types of spirits. This reduces your risk while increasing the chances of finding a bottle that appreciates significantly in value.

About this point, again, your T.S.C. personal portfolio manager will take care of everything, from suggesting various mixes of bottles based on the budget you plan to invest in your first profitable whisky collection, to sourcing at the best market price, and even selling part of the collection to take profit or, once the goal is reached, facilitating a total liquidation.

3. What to Look for in Rare Spirits

Provenance and Authenticity

Always verify the authenticity of a bottle before purchasing. Provenance, or the history of ownership, plays a huge role in determining a spirit’s value. Bottles with clear, verifiable origins are more desirable to buyers and collectors. The Spirits Club will ensure about the bottles’ seals as well as about the integrity of the original packaging. When buying by private sellers, cases of packaging tampering frequently occur (not original one or wrong packaging for the edition of the bottle, for example). Our whisky experts are skilled to research and purchase on client’s behalf only the investment-grade bottles, those are the ones with perfect seals and intact original packaging. Beware of D.I.Y.!

Age and Vintage

Older spirits, particularly those that were distilled decades ago, are highly sought after. Bottles that come from a limited run or a discontinued distillery can see immense appreciation in value. A distillery that has stopped production of a particular spirit often creates a high demand for remaining bottles. Obviously, not every closed or silent distillery’s bottle is worth to be purchased, but only the ones that enclose several characteristics and requirements that will guarantee future increase of value.

Another point is the year of distillation: a whisky distilled in the 1960s, for example, is rarer than a 12-year-old bottle released this year. However, on this point, other factors also come into play, such as the release of the specific edition, the number of bottles opened over time, the bottler used, and many other elements that will make you think twice about making a whisky bottle purchase based solely on “feelings.”

Limited Editions and Collectible Releases

Brands often release limited edition bottlings to mark special anniversaries, milestones, or unique production processes. These limited editions are typically produced in small batches and are more likely to appreciate in value over time. Keeping an eye on industry announcements and upcoming releases is a great way to identify collectible bottles early.

Brand Reputation

Certain brands have a long-standing reputation for producing high-quality, collectible spirits. Brands like Macallan, Dalmore, GlenDronach, and Ardbeg are known to consistently appreciate in value. It’s worth aligning your investment choices with established, respected distilleries.

The Karuizawa 52-year-old 1960 is a famous example of the high returns from whisky bottles produced by closed distilleries. The price of one this bottles nowadays exceeds GBP 650.000

4. Buy and Sell Rare Spirits

As specialist operators, focused on investment-grade spirits, we can offer valuable advice and have access to limited or super-limited editions or rare bottles not available in regular retail outlets. Since it is important to verify the authenticity and provenance of the bottles, purchasing from private individuals is always a gamble: cases of counterfeiting have increased in recent years, even among high-value bottles. For this reason, we rely on the best whisky and spirits experts worldwide, as well as portfolio managers specialized in alternative investments in tangible assets.

Conclusion

This guide offers a solid foundation for anyone looking to invest in alternative assets, hugely profitable like rare spirits bottles.

The Spirits Club incorporates all the steps for buying and selling premium spirits collections profitably into a personalized investment system, relieving the investor from all the typical risks of an investment, which would pose a serious threat to the return on investment if you decided to proceed on a do-it-yourself basis. Investing in rare spirits can be a rewarding endeavor for both your passion and your portfolio. Over time, your collection will appreciate in both monetary and personal value, making it a truly enjoyable asset class to hold. However, this will happen only if you buy now the right pieces for your collection. Contact us to learn more.

Why invest with The Spirits Club?

Our expertise is to identify the labels suitable for investment purposes and capable of generating profits above the market average.

- Investment in rare and prestigious bottles worldwide

- High experience in the search and availability of bottles

- Product and management transparency

- Exclusive ownership of the investor

- Pool of experts at the top of world collecting in spirits

- Portfolio managers experienced in the management of luxury assets

- Ongoing advisory approach to investors

- Indication of the best moment of liquidation of the product

- Possibility to liquidate at any time in case of need.