Collecting rare whiskies sometimes turns into true treasures to be kept for generations in dedicated and controlled environments. Medium to short-term investment purposes have modified their objectives from preserving and increasing value for the family’s needs and its descendants to obtaining a profit usable at the time of liquidation, similar to what happens in the case of shares in financial investment funds.

Investing in high-quality spirits bottles involves several phases, starting from market research to identify pieces with the highest potential value increase, choosing how to preserve the collections, and culminating in the moment of sale. To achieve the profit objective of the entire operation in the best way and time, it is necessary to have an in-depth knowledge of the market.

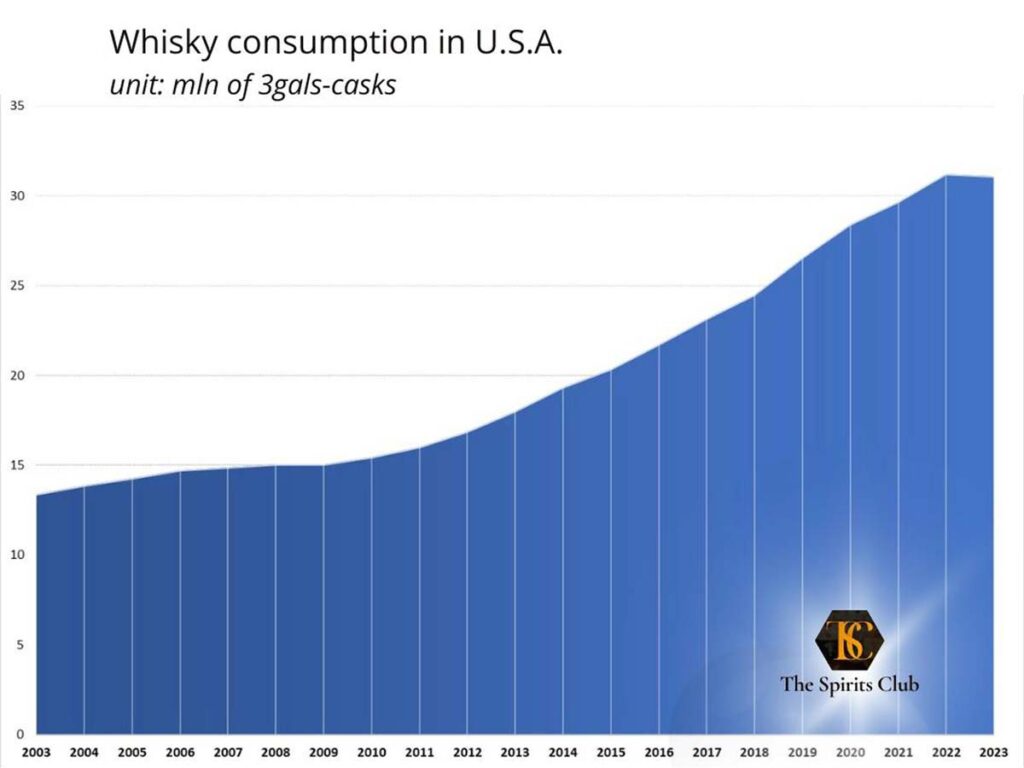

The consumption of whisky in the United States, the country with the highest capacity to absorb global whisky production, shows a steadily increasing volume trend. This data may seem unrelated to luxury whisky, the sector of our interest, but upon deeper reflection, one realizes that since whisky is a high-end alcoholic product, rare bottle purchases for investment purposes are automatically included in the graph data. This progressively depletes the investment bottle market, thus increasing their value and yield.

The ideal time to resell investment whisky bottles can vary depending on several factors such as the rarity of the whisky, the brand, market demand, and also, as mentioned initially, based on one’s profit objectives. However, there are some general guidelines that can help the investor determine the right time to sell:

- Short term (1-3 years):

some limited editions or particularly rare whiskies can rapidly increase in value in the short term, especially if demand is high immediately after release. The concept of “short term” in other sectors maybe shorter, such as in currency trading or stocks, especially in the tech sector; even more so in the crypto world, where short-term operations are mostly speculative. In the collectible whisky sector, one must consider that the operation involves buying and selling with generally extended timelines. Thus, keeping a series of bottles in the portfolio for one or two years is a very short period that can easily yield double-digit profit percentages if the selection includes limited editions or very aged whiskies with soaring trading volumes when acquired. Naturally, access to these very specific data is available to sector operators, which is why The Spirits Club offers itself as a trusted advisor and manager of its clients’ collections, precisely indicating the most favourable times to liquidate or increase individual positions. - Medium term (3-5 years):

many experts believe that a period of 3-5 years is often a good timeframe to see investment whisky bottles appreciate significantly. A longer period can sometimes indicate purchasing bottles at a non-optimal price, requiring longer storage to appreciate a notable profit. Be wary of “experts” advising longer periods than initially projected before starting the investment: this temporal shift could hide a lack of expertise that led the client to purchase certain bottles at an unsuitable market period for those specific labels, hence the mentioned expert will mask their evaluation error by “parking” your bottles in the portfolio longer, waiting for the promised gains to materialize. - Long term (5-10+ years):

particularly valuable bottles, such as those from closed distilleries or very limited editions, can reach their maximum value over several years. This period allows maximizing scarcity and increasing demand. Nowadays, some distilleries have been closed for many years, making the so-called “long term” sometimes a medium term or even a short term in the presence of extremely scarce and highly traded bottles at auction.

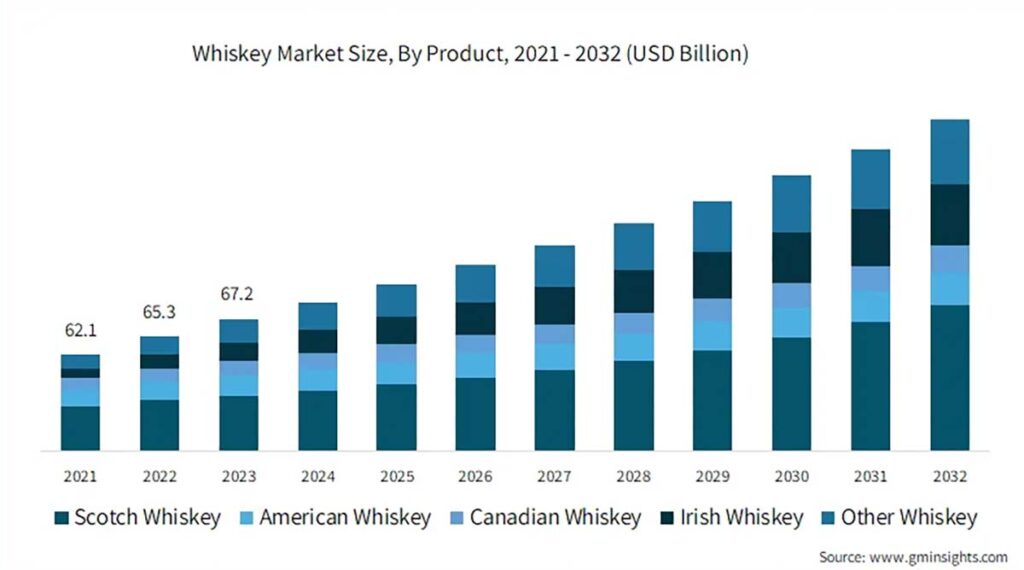

The graph source: www.sminsights.com, highlights the overall increase in sales volumes of all types of whisky, with primary contributions from Scotch whisky and Irish whiskey. The distribution is a projection from now until 2032, not considering the potential increased demand from large emerging countries like India, China, South America, and Eastern European countries, which would shuffle the cards and further increase the figures shown here)

It is essential to regularly monitor the market, have contacts with a network of experts who provide accurate periodic reports on the performance of individual releases and editions, the frequency of selling bottles with the same serial number (indicating a high volume of trades on generally very rare bottles), and note the initial release prices of bottles and their selling or auction prices over various periods. Specialized companies allow integrating all these skills into a single reference and responsibility centre, giving the client greater security in realizing a given profit within a specified timeframe. The Spirits Club, for example, is a leader in high-quality spirits bottle investment for private, corporate, and institutional clients, offering a complete service that includes:

1. A preliminary consulting phase to screen the investor’s needs;

2. An evaluation phase proposing various portfolio alternatives accompanied by different profit projections over time;

3. A portfolio purchase phase where the bottles bought by the investor are included, with the issuance of related purchase documentation and certificates of ownership and authenticity of the bottles;

4. A phase for insured storage of the bottles at the company’s proprietary accounts in tax warehouses exclusively accessible by the company’s management and the collection’s owner;

5. A phase for selling the bottles and realizing the related profit.

Throughout these phases, continuous communication between the personal TSC consultant and the investor includes updates on price trends, profit objectives updates, client liquidation timelines, and possible modifications to the asset based on needs to increase positions, reduce exposure on certain labels, or take the opportunity to sell some of them early.

In any case, the investor client has only the obligation to deposit the initial investment amount and collect the proceeds from the liquidation, as the entire monitoring, purchase, and resale, asset modification, and collection custody work is managed by the company.

Why invest with The Spirits Club?

Our expertise is to identify the labels suitable for investment purposes and capable of generating profits above the market average.

- Investment in rare and prestigious bottles worldwide

- High experience in the search and availability of bottles

- Product and management transparency

- Exclusive ownership of the investor

- Pool of experts at the top of world collecting in spirits

- Portfolio managers experienced in the management of luxury assets

- Ongoing advisory approach to investors

- Indication of the best moment of liquidation of the product

- Possibility to liquidate at any time in case of need.