The high volatility of traditional markets, combined with their unpredictable performance, has pushed many international investors to increasingly diversify their portfolio into luxury assets. We offer safe investments in the UK and worldwide.

Our experts and our network have a huge and important experience in the sale of fine spirits giving you access to safe investments in the UK.

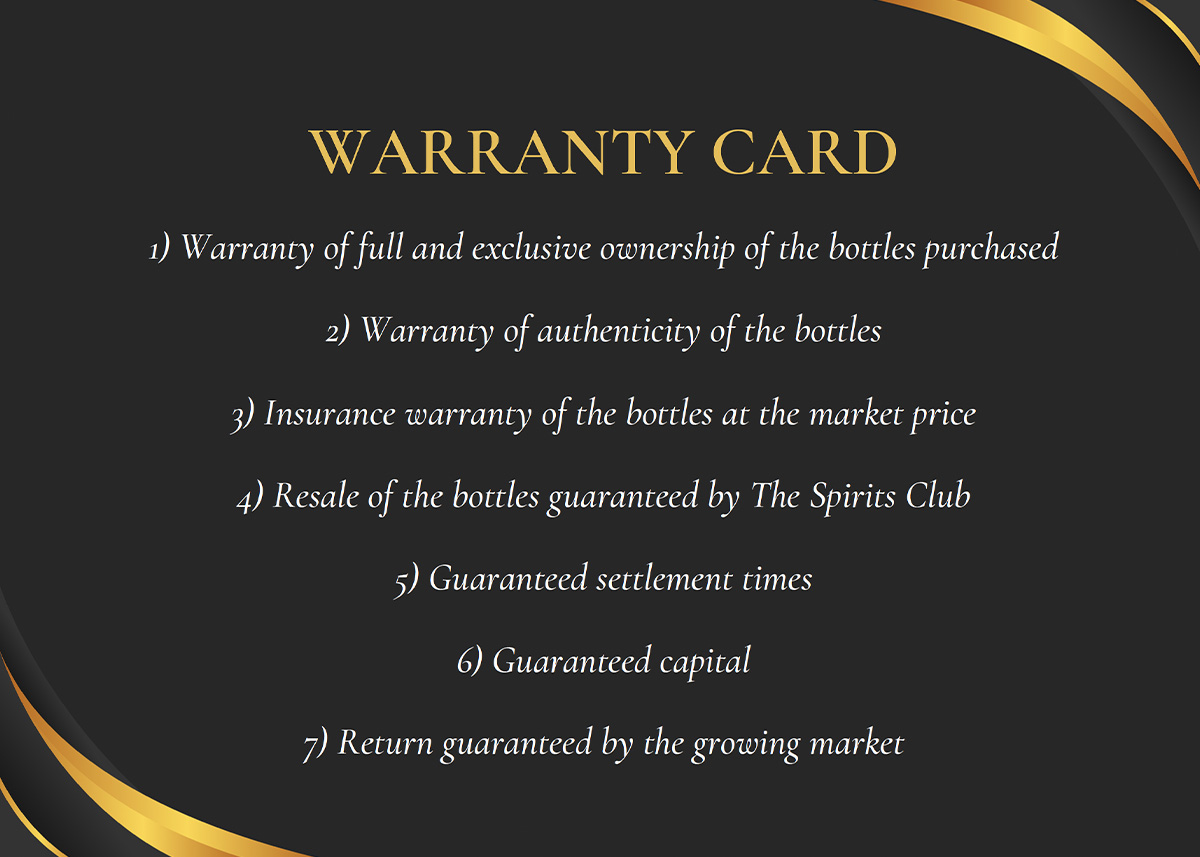

The Spirits Club was born from this expertise and with its consultants also brings their know-how, creating a safe business model full of guarantees for the investors client.

Comparison to Whisky: Real estate requires significant capital investment and ongoing maintenance, while whisky investment typically requires less initial capital and minimal upkeep.

Reason for Being a Less Appealing Option:Real estate may be less appealing due to its illiquidity, high transaction costs, and the potential for market downturns impacting property values. Whisky offers greater flexibility, liquidity, and potentially higher returns on safe investments in the UK in a shorter time frame.

Comparison to Whisky: Commodities like gold and oil are subject to price volatility and market speculation, whereas whisky investment offers stability and potential appreciation over time.

Reason for Being a Less Appealing Option: Commodities may be less appealing due to their speculative nature, lack of intrinsic value, and susceptibility to external market factors. Whisky, on the other hand, provides a tangible asset with inherent value and a growing market demand.

Comparison to Whisky: Private equity investments typically require longer investment horizons, higher minimum investment amounts, and offer limited liquidity compared to whisky investment.

Reason for Being a Less Appealing Option: Private equity may be less appealing due to its illiquidity, higher risk profile, and longer timeframes for potential returns. Whisky investment offers greater flexibility, potential for quicker returns, and enjoyment factor.

Comparison to Whisky: Hedge funds often have high fees, lack of transparency, and limited liquidity compared to whisky investment.

Reason for Being a Less Appealing Option: Hedge funds may be less appealing due to their complexity, high fees, and lack of transparency. Whisky investment offers greater transparency, potential for higher returns, and a tangible asset with intrinsic value.

Comparison to Whisky: Art and collectibles can be subjective in valuation, illiquid, and require specialised knowledge for investment, whereas whisky investment offers greater transparency and potential for appreciation.

Reason for Being a Less Appealing Option: Art and collectibles may be less appealing due to their illiquidity, subjective valuation, and lack of transparency. Whisky investment offers greater liquidity, potential for higher returns, and a more straightforward investment process.

Comparison to Whisky: Cryptocurrency is highly volatile, subject to regulatory uncertainty, and lacks intrinsic value, whereas whisky investment offers stability, tangible value, and potential for appreciation.

Reason for Being a Less Appealing Option: Cryptocurrency may be less appealing due to its high volatility, security risks, and regulatory concerns. Whisky investment offers greater stability, tangible value, and potential for long-term growth.

In summary, while each alternative investment has its merits, whisky investment stands out as a more appealing option due to its combination of tangible value, potential for high returns, liquidity, and enjoyment factor. Whisky offers investors a unique opportunity to diversify their portfolios, hedge against market volatility, and participate in a growing market with increasing global demand for rare and fine whiskies.

Historical Performance: Whisky has a proven track record of increasing in value as it ages. Unlike many financial assets that can be highly volatile, the value of premium whisky tends to rise steadily. This makes it a reliable option among the best things to invest in, especially for those looking for long-term gains.

Tangible Asset: As a physical commodity, whisky is less susceptible to market swings compared to stocks and bonds. This tangible nature offers a level of security, making it an attractive low-risk investment. It’s a product with intrinsic value that doesn’t depend solely on market sentiment.

Limited Supply and Growing Demand: The production of high-quality whisky is limited by time and resources. With increasing global demand, particularly from emerging markets in Asia, the scarcity of premium whisky bottles and casks ensures that their value continues to climb, reinforcing whisky as one of the best places to invest money without risk.

Cultural and Historical Significance: Whisky has a deep cultural significance, particularly in regions like Scotland and Japan, which are known for their premium whisky production. This cultural value adds to the stability of whisky as an investment, as it remains a coveted item for collectors and connoisseurs worldwide.

Diverse Investment Options: Investors can engage in the whisky market through various means, such as purchasing individual bottles from different areas and age indication. This diversity allows investors to tailor their investment strategy to their risk tolerance and financial goals, further underscoring whisky’s status as a low-risk investment.

Resilience to Economic Downturns: Historically, luxury goods like premium whisky have shown resilience during economic downturns. Collectors and investors often continue to seek out rare and high-quality whiskies regardless of broader economic conditions, ensuring steady demand and protecting the investment’s value.

info@yourspiritsclub.com

207 Regent Street, W1B 3HH

London, United Kingdom

PH. +44 02087980697

Via Roberto Lepetit 8/10

20124 Milano, Italy

PH. +39 3792088040

Chrysler Building, 26th floor, 405 Lexington Avenue

New York City, 10174, USA

PH. +1 6464753785

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-advertisement | 1 year | Set by the GDPR Cookie Consent plugin, this cookie records the user consent for the cookies in the "Advertisement" category. |

| cookielawinfo-checkbox-analytics | 1 year | Set by the GDPR Cookie Consent plugin, this cookie is used to record the user consent for the cookies in the "Analytics" category . |

| cookielawinfo-checkbox-functional | 1 year | The GDPR Cookie Consent plugin sets the cookie to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 1 year | Set by the GDPR Cookie Consent plugin, this cookie is used to record the user consent for the cookies in the "Necessary" category . |

| cookielawinfo-checkbox-others | 1 year | Set by the GDPR Cookie Consent plugin, this cookie stores user consent for cookies in the category "Others". |

| CookieLawInfoConsent | 1 year | Records the default button state of the corresponding category & the status of CCPA. It works only in coordination with the primary cookie. |

| elementor | never | This cookie is used by the website's WordPress theme. It allows the website owner to implement or change the website's content in real-time. |

| viewed_cookie_policy | 1 year | The GDPR Cookie Consent plugin sets the cookie to store whether or not the user has consented to use cookies. It does not store any personal data. |

| wp-wpml_current_language | session | WordPress multilingual plugin sets this cookie to store the current language/language settings. |

| Cookie | Duration | Description |

|---|---|---|

| _fbp | 3 months | Facebook sets this cookie to display advertisements when either on Facebook or on a digital platform powered by Facebook advertising after visiting the website. |

| _ga | 1 year 1 month 4 days | Google Analytics sets this cookie to calculate visitor, session and campaign data and track site usage for the site's analytics report. The cookie stores information anonymously and assigns a randomly generated number to recognise unique visitors. |

| _ga_* | 1 year 1 month 4 days | Google Analytics sets this cookie to store and count page views. |

| CONSENT | 2 years | YouTube sets this cookie via embedded YouTube videos and registers anonymous statistical data. |

| Cookie | Duration | Description |

|---|---|---|

| VISITOR_INFO1_LIVE | 5 months 27 days | YouTube sets this cookie to measure bandwidth, determining whether the user gets the new or old player interface. |

| VISITOR_PRIVACY_METADATA | 5 months 27 days | Description is currently not available. |

| YSC | session | Youtube sets this cookie to track the views of embedded videos on Youtube pages. |

| yt-remote-connected-devices | never | YouTube sets this cookie to store the user's video preferences using embedded YouTube videos. |

| yt-remote-device-id | never | YouTube sets this cookie to store the user's video preferences using embedded YouTube videos. |

| yt.innertube::nextId | never | YouTube sets this cookie to register a unique ID to store data on what videos from YouTube the user has seen. |

| yt.innertube::requests | never | YouTube sets this cookie to register a unique ID to store data on what videos from YouTube the user has seen. |