What are the advantages of investing in tangible assets over traditional stocks? The financial purpose is fossilized on stocks and products related to stock market indices; however, there is the possibility of owning assets capable of generating unthinkable profits. Among the range of varied assets, The Spirits Club has chosen fine spirits, considered the best medium and long-term investments, available in the tangible asset market. We try to explain some key points about this investment in this article, trying help everyone, even to newbies understanding tangible assets, thinking about taking advantage of this investment opportunity.

Definition of a tangible asset

A tangible asset is a physical asset that has a clear and measurable value and can be seen and touched.

These assets are used by companies and individuals to generate income or improve operations.

Examples include machinery, buildings, land, equipment, and inventory.

In the case of assets that are likely to be able to produce an income thanks to their appreciation in value, we turn our attention to wristwatches, vintage cars, historical coins, jewellery and bottles of fine and rare spirits.

At The Spirits Club, we expressly deal with bottles of collectible and investment spirits.

Why did we choose this particular asset?

The reasons are to be found in our management history, in the analysis of the taxation of this asset and in the percentage of average profit that we can achieve with bottles of rare whiskies and collectible rums.

Obviously, it is not enough to just buy the bottles, but it is mandatory to know this sector in depth, the economic trend of each distillate, the individual editions, the number of bottles that have been released under that specific label, as well as many other characteristics that must be studied for years, in order to offer the investor the best portfolio solution with the best performance.

In previous articles we have explained how to invest in fine spirits and now we will list the benefits of this investment, with an average annual return of 25%-30%.

Figure nr. 1: The most awarded distilleries are active in the production of commercial whiskies as well as in the release of aged whiskies, often in strictly limited editions, intended for collecting and investment. Many of these distilleries are the subject of attention from investment funds, banks and financial companies that have added investment in rare whisky to their portfolio.

Understanding Tangible Assets: Advantages over traditional investments

Investing in rare whiskey bottles is gaining popularity as an alternative investment, offering significant advantages over traditional investments.

Before listing the benefits of this asset, it is useful to understand the meaning of investment: an investment is the act of allocating resources, usually money, with the expectation of generating income or profit in the future.

The key aspects of an investment are the capital outlay, the expectation of return, i.e. an expectation of financial gain or growth in value over time.

Risk: There is generally always some level of risk in an investment, which means that the return is not guaranteed.

And here we list one of the main advantages of investing in bottles of fine spirits over traditional assets: ownership of tangible assets, which is sufficient to guarantee the initial capital outlay.

In addition to this, there are other very important qualities of this asset, which distinguish it from other traditional assets:

1. Rare whisky bottles, especially those from sought-after or limited edition distilleries, are greatly appreciated over time. Some bottles have produced returns far superior to traditional assets.

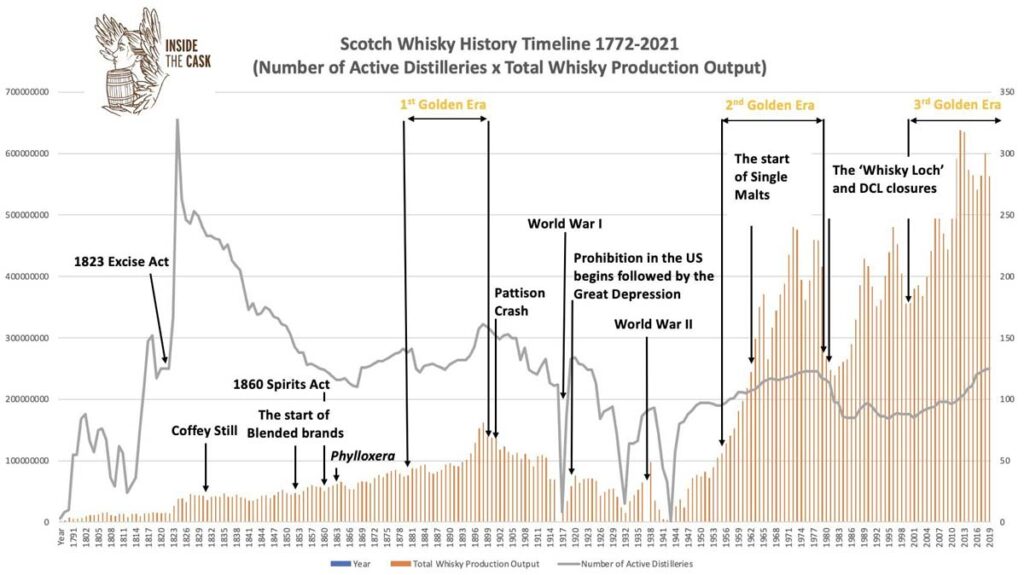

Figure 2: Courtesy of insidethecask.com: This graph highlights the correlation between major historical events and the number of operating distilleries, compared to the total amount of whisky produced. The meaning of this chart is in the article.

2. Whisky is consumed over time, which reduces the numerical availability of bottles on the market which, compared to their constantly increasing demand, generates a consequent increase in the value of the bottles remaining in the market.

3. Unlike stocks or cryptocurrencies, whiskey is a tangible asset that can provide a sense of security for investors. Physically owning something precious, insured, that can be preserved and appreciated over time.

4. Furthermore, being a non-financial asset, rare whiskey is not affected by stock market fluctuations, offering a very valid alternative to diversify one’s assets, sheltering from the volatility typical of traditional markets.

5. The value of whiskies does not depend on the performance of the financial markets, interest rates or inflation. On the other hand, thanks to its total decoupling from the market, it offers portfolio diversification, helping investors to reduce the risks associated with traditional investments.

6. Demand for fine and rare spirits, particularly in emerging markets such as China and India, continues to grow. These ever-expanding markets contribute to the appreciation of the value of bottles over time.

As far as the availability of fine whiskies worldwide is concerned, it is necessary to dwell on the wide difference (photo nr.2) between the quantity of bottles produced in recent years and the number of active distilleries, decidedly below the historical average.

There are certainly two lines of production to be considered in this regard.

On the one hand, in fact, it is important to note that, despite the large quantity of spirits produced, the permanent shortage of bottles of “investment” whiskey suggests that the quantities of whisky intended for consumption – meaning the latter as “commercial” whiskey – do not influence the production of that intended for collecting and investment, because the quantities produced of the latter are always infinitely small to meet their demand which is increasingly high and which pushes – and will continue to drive – their prices towards a continuous rise.

Another useful observation is that, if the number of active distilleries is currently below the historical average, it means that there are even fewer distilleries producing fine whisky than in the past, and this once again acts as a powerful profit multiplier for those who have invested in bottles of rare spirits.

Role in a diversified portfolio

Portfolio diversification is one of the main benefits of understanding tangible assets. Investing in fine spirits can be not only more effective than a financial investment, but also pleasant for collectors who appreciate them.

There is a cultural and emotional appeal to owning iconic bottles of rare whiskey that does not exist in stock or bond investing. There are extremely profitable distillates to be ignored as an investment.

However, apart from the emotional aspects, which can leave the time they find, the investment in fine spirits also brings significant advantages from a tax point of view.

In fact, in several countries, the capital gain is exempt from taxation.

This feature makes them more attractive than any other investment that is normally taxed.

Not only that, historically, whiskey has proven to be the safe-haven asset par excellence, demonstrating a very strong resilience even during economic recessions.

When you start understanding tangible assets, you’ve got to start here: As a luxury good, demand for premium spirits remains stable and increases during times of economic uncertainty.

While bottles of rare whisky offer the potential for strong returns, valuable opportunities for wealth diversification and tax advantages, they require specialist knowledge and measures to ensure that they are properly preserved.

Storing bottles in insured storage depots is our choice to ensure their optimal preservation and appreciation over time.

Why invest with The Spirits Club?

Our expertise is to identify the labels suitable for investment purposes and capable of generating profits above the market average.

- Investment in rare and prestigious bottles worldwide

- High experience in the search and availability of bottles

- Product and management transparency

- Exclusive ownership of the investor

- Pool of experts at the top of world collecting in spirits

- Portfolio managers experienced in the management of luxury assets

- Ongoing advisory approach to investors

- Indication of the best moment of liquidation of the product

- Possibility to liquidate at any time in case of need.