Going deeper into the field of investments, it becomes imperative to emphasize the strategic importance of tangible assets, broadening the focus beyond traditional investments. In the dynamic landscape of wealth management, the appeal and resilience offered by tangible assets to diversify your portfolio.

Among the tangible assets, which includes a wide spectrum ranging from real estate to precious metals, diamonds, bags, vintage cars, works of art, some assets with particularly distinctive traits emerges, both for their high prestige in the market and for their constant growth in value over time, thus bringing security and vitality to investment portfolios.

Moreover, unlike intangible assets, tangible assets provide a guarantee of physical presence, giving a sense of solidity and security to our investment.

Investors turn to tangible assets because of their inherent ability to be a store of value, especially during times of high economic uncertainty.

But this ability is not typical of all tangible goods without distinction, particularly belonging to collectible spirits, which also act as a powerful shield against the long-awaited inflation.

These, basically, are the characteristics that distinguish it, making it excel over all other alternative assets, the investment in rare whiskies and fine spirits.

Whisky, as a tangible luxury investment, emerges as a distinctive asset, marrying opulence with the security and profitability of the investment.

The rarity and exclusivity of fine whiskeys position them as extremely profitable assets, coveted by investors but also by the most attentive and demanding collectors, offering an opportunity for generous returns on investment. Diverse tangible investment is a great option to grow your portfolio and returns.

The luxury dimension offered by this type of investment extends beyond fine whiskies to encompass a broader spectrum of rare spirits, each contributing to a unique level of sophistication for a validly diversified portfolio.

Macallan Red Collection: The set in the photo differs from the standard version and can be identified by its exclusive labels, illustrated and signed by the Spanish artist Javi Aznarez. Only two sets contain these labels: one set will remain in The Macallan’s archives and the second set will be presented at Sotheby’s auction.

Fine whiskies, being rare and tangible assets, act as a counterweight to market fluctuations, contributing to a well-rounded investment strategy. Diversification through luxury assets, as is well known, greatly mitigates the risks associated with economic uncertainties, providing a safeguard against the unpredictable nature of financial markets.

Why include fine spirits in your investment portfolio?

The answer lies in their high value now crystallized in the market and lies in the amplified diversification they bring, strengthening stability and introducing resilience.

Preserving heritage through luxury whiskey

In the pursuit of heritage preservation, the inclusion of tangible luxury goods such as collectible rare spirits bottles takes on added significance, offering a unique blend of uniqueness and lasting, incremental value that is the result of the same uniqueness and the continuous reduction in the supply of bottles intended for investment.

Tangible assets to diversify your portfolio: Whiskey and fine spirits

High-end whiskey bottles provide a hedge against market volatility, ensuring a more structured financial portfolio to combat and minimize sensitivity to exogenous market factors. Fine whiskey has come its ability to preserve wealth over the long term, often outpacing inflation and providing security due to its tangible nature.

Fine whisky in bottles serves not only as a financial asset, but also as a culturally and historically rich artifact, capable of perpetuating from generation to generation the testimony of human ability to create true works of art in liquid form not subject to deterioration but only to further evolution of one’s qualities and exclusivity, contributing to a legacy of wealth preservation.

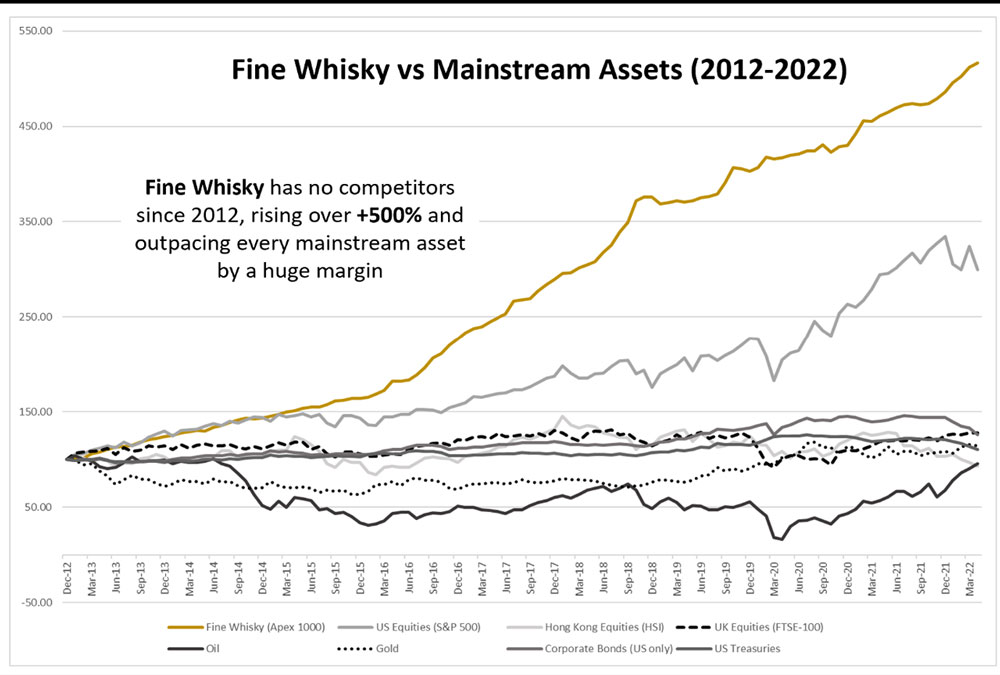

Comparison between traditional assets (commodities, stock indices, government bonds) and the Whisky Apex 1000 index: the latter is clearly uncorrelated from the others, precisely because of the total insensitivity of the collectible whisky sector with respect to the factors that normally influence the financial markets.

Investing in bottles of rare spirits also lends itself to being considered as a treasure to be handed down to one’s children and grandchildren, precisely because of the incremental nature of the value of these bottles, real treasure chests free from devaluations due to sudden geopolitical or financial events. Capital protection even concerns the tax aspect, since collections of valuable alcoholic goods are not subject to any taxation or profit tax in many countries. In short, the advantages are many and certainly worthy of the attention of the dynamic investor projected to keep the performance of his portfolio high.

Evolving in investing

In conclusion, the strategic integration of tangible luxury investments, such as collectible spirits bottles, into an investment portfolio, unveils a nuanced and comprehensive approach to wealth management. By intertwining the luxury asset segment and the tangible form of the assets being invested, investors not only diversify their risk, but also open the door to a realm where rarity and exclusivity merge with lasting financial value.

The dynamic investment landscape, enriched by bottles of rare whisky, adds a distinctive chapter to the narrative of financial resilience and heritage preservation. As we navigate the complexities of the market, fine spirits provide investors with a solid foundation for growth and successful capital deployment in both the short, medium to long term. Embracing investing in alternative assets such as collectible whisky allows investors to tap into profit opportunities unthinkable for any traditional asset, ensuring a well-rounded portfolio that can withstand the ever-changing currents of the financial world. In the quest for wealth and financial well-being, bottles of fine spirits emerge not only as investment tools, but also as guardians of prosperity, from generation to generation.