What defines a luxury goods investment

Luxury means performance and exclusivity.

Investing in luxury, in its highest sense, is the main need and prerogative of every investor who chooses to allocate their capital to a safe and profitable asset.

In fact, most of the goods that fall into the extra luxury category enjoy such a strong and crystallized positioning in the market, so much so that they are defined as safe havens assets.

Safe-haven assets, in fact, are able to offer an high degree of financial stability and a constant growth in value over time, so much so that they prove to be a real safety shield, especially in times of economic market instability, recession or financial crisis.

One of their main characteristics is undoubtedly that they do not run into unpleasant phenomena that would cause the depreciation of their value.

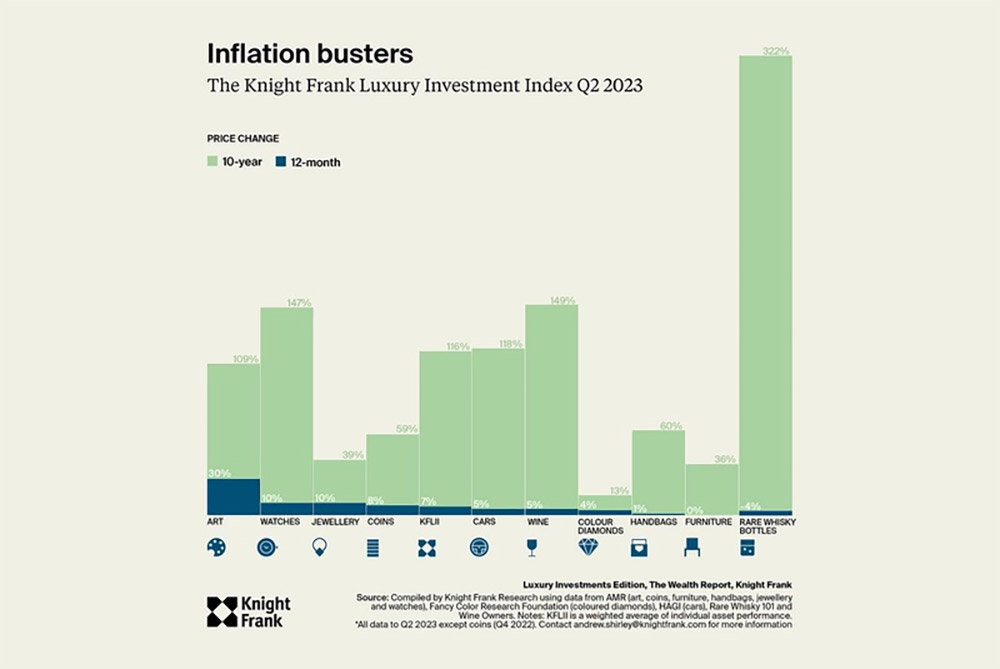

In particular, among the so-called pleasure assets, there are rare collectible spirits, which ignore the problem related to inflation.

The investment in fine collectible spirits and rare whiskies, in fact, is the only one among the various alternative investments to have a strong ability to resist inflation, as clearly evidenced in the very recent Knight Frank Luxury chart for the year 2023.

Whisky as a safe haven

Among the alternative investments, the investment in collectible spirits and rare whiskies is in an extremely particular but also privileged position.

The main reason why the asset of rare whiskies always excels over all other alternative investments such as gold, jewelery, art, bags, vintage cars, etc., lies in the fact that these are manufacturers with an extremely long history and with such a strong market positioning that it is now super crystallized in the market.

In fact, there are not, and never are, periods of depreciation of fine spirits.

This increasingly frequent trend of constant increase in the value of whiskey over time is due, in addition to the reasons mentioned above, also to an extremely limited production base of the collections that can vary from the single and only piece produced, up to a maximum production that does not exceed 500 bottles in total.

This production should satisfy the entire global demand; but it is easy to guess that 500 bottles produced are not able to satisfy even the demand of a small country, let alone the entire world demand.

And it is precisely thanks to this perfect combination, due to the very high prestige of the distilleries and the super limited production of the product, that the value of these iconic collector’s pieces increases steadily over time.

Not only that, but it must also be considered that in this sector, there are several categories of users; investors, collectors, consumers.

Once a bottle of this prestige is placed on the market, there is a real “competition” between those lucky ones who are able to grab that iconic product, available in very few pieces.

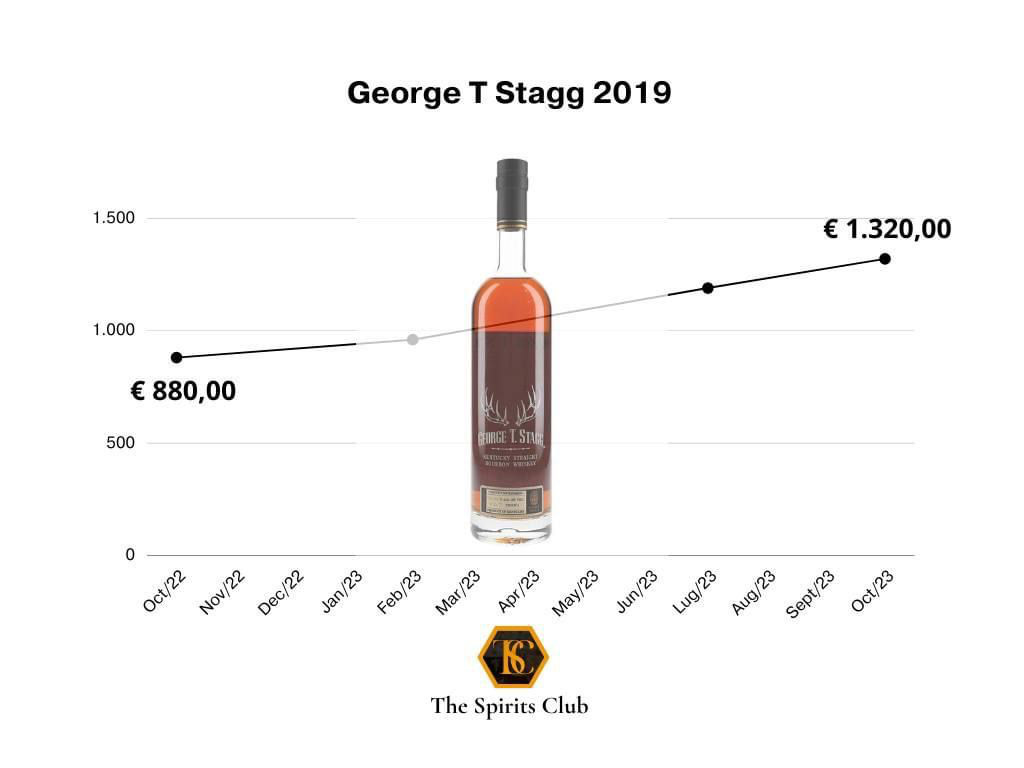

Quickly then, those few bottles put into circulation are assigned or consumed among the luckiest, with the logical consequence that those who have purchased that bottle have in fact a real trophy in their hands, which will continue its rapid and constant growth in value over time.

This is why the fine collectable spirit is the safe haven asset par excellence.

Why rare whisky never depreciates over time

It is useless to deny that, more or less, almost all assets suffer losses in value, most of the time because they are strongly linked to the volatility typical of the markets, other times closely related to the moments of particular popularity of the asset, and all are unfortunately exposed to the ruthless cleaver of inflation.

Rare whiskey and other luxury goods investments has never seen a loss of value over time.

This is its most important feature that makes it a real safe haven asset, in which to invest your capital, without expecting nasty surprises related to its depreciation but able, on the contrary, to perform quickly and to be able to be resold in the market at staggering figures.

The older the whisky, the harder it is to find it in circulation.

Nowadays owning a bottle aged for a few decades means owning 75cl the value of a property.

But that asset, unlike a property, in addition to not having the typical costs of a property, will not even be available in duplicates, with the logical consequence that those who own it, in fact hold a real trophy, whose value is linked to its uniqueness.