What does it mean to invest in whisky

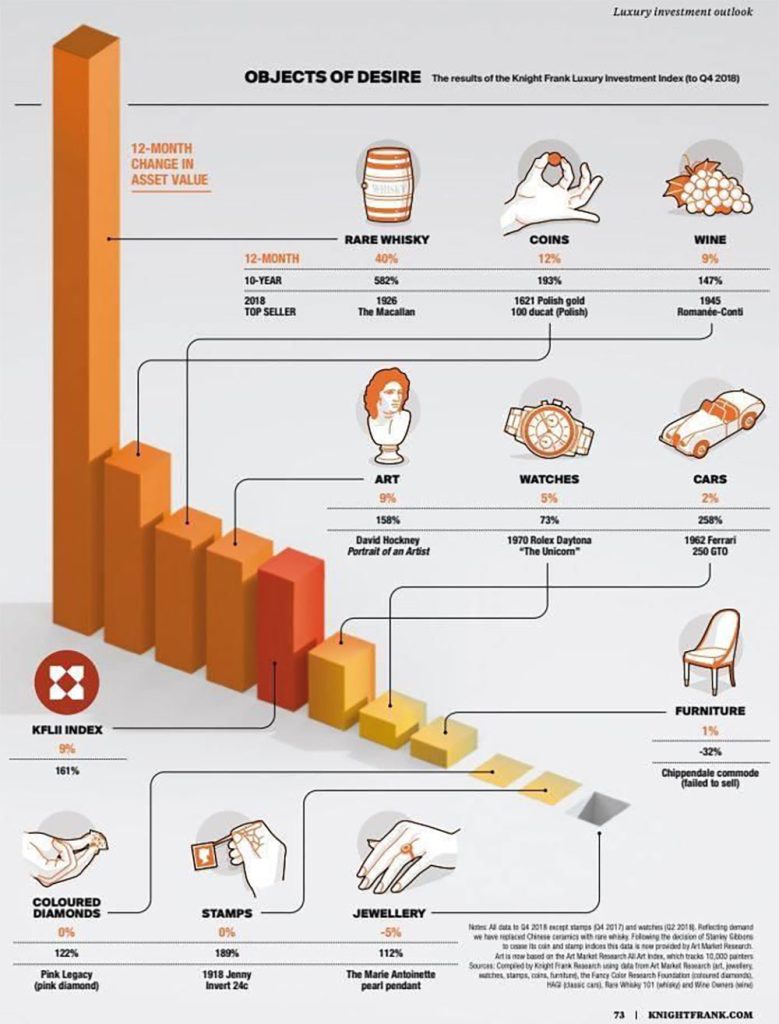

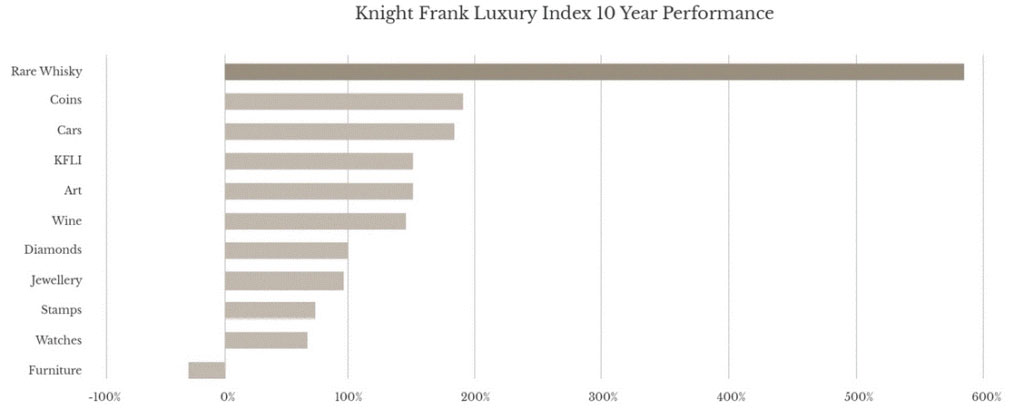

Investing in rare whiskeys and fine spirits with The Spirits Club, in fact, means buying full ownership of physical, material and tangible assets that are precisely the bottles of fine spirits and means investing in the most profitable alternative asset, as demonstrated by the authoritative Knight Frank Luxury Index that estimates the performance of the various luxury goods. See the comparison of whiskey investments compared with other tangible assets.

It is not, therefore, a question of investing in securities, in an investment fund whose very idea would be almost bankrupt, nor of owning shareholdings and.

You invest, therefore, in a real asset, with a precise quotation in the market.

Full ownership of the spirit collections, however, confers on the rightful owner many guarantees and benefits.

First of all, the guarantee of not losing its invested capital, nor the increase in value of the collections over time.

Thanks to this total patrimonial separation between the assets of the company and the assets of exclusive property of the investor, in fact, the investor owner of his collections, will not run the risk of seeing his invested assets subtracted, in case of unfortunate fate of the company.

The investor has, therefore, the guarantee of separation and total demerger of his assets with respect to the assets owned by the company.

Not only that, but the full ownership of the collections also allows the rightful owner to have full freedom to dispose of them as he prefers.

This means, therefore, choosing to liquidate them totally or partially, at any time, without constraints, obligations or penalties of any kind, collecting the due profit when desired.

Liquidation of the investment in rare whiskies and fine spirits

The liquidation whiskey investments with The Spirits Club

One of the most important guarantees offered by The Spirits Club concerns the future resale of the collections purchased by investors, already having its own channel for liquidating the collections.

It will therefore not be the concern or burden of the investor to look for third parties to conclude his investment at the most important moment that precisely concerns the liquidation of the amount he has invested, with consequent collection of the money.

Certainly, but not least, the prompt liquidation we are talking about concerns only and exclusively the bottles of whisky and in general of the fine spirits, certainly not of the whisky barrels.

An investment is considered advantageous not only because it is highly performing, but also because it guarantees an immediate liquidation of the product.

A valuable bottle, in fact, is easily liquidated because it is in great demand as a product already finished by starred restaurants, large hotel chains, luxury bars or private collectors.

The barrel, on the other hand, poses enormous problems related to the most important phase of an investment, which is precisely the liquidation, without neglecting the lower performance that it can offer compared to those of a valuable bottle already packaged and ready for resale.

The barrel encounters very important problems related not only to the liquidation times that can be very long and uncertain, placing the investor in a situation of limbo and great uncertainties regarding the time of exit, but also of the collection that he will be able to obtain from the resale of his share of the barrel purchased.

This is simply due to the fact that no bottling company, of course, will be able to guarantee that the future brand of bottles also coming from the barrel of the most famous whisky brand, will establish itself in the market as much as the brand of the barrel from which they derive and above all how long that brand it will take to establish itself in the market, at least to a minimum extent to be able to include the investor in the amount invested.

Boasting a positioning now crystallized in the market enjoyed by the most important prestigious distilleries, thanks to their very long historicity, is certainly not possible within a few years.

Pondering, therefore, the object of the investment to make a wise choice, is at least a duty.

Rare whisky investments and fiscally priced spirits

Taxation of investment in fine spirits

Investment in rare whiskies and fine spirits is untaxed.

This means that the entire proceeds that the investor will obtain from the future resale of his collections, will not be subject to any type of taxation on the capital gain.

The sale of valuable bottles is seen by the State as an occasional sale of a collector’s item and therefore, since there is no continuity in operations, therefore, whiskey investments are not taxed.

The exempt States concerning several countries, including Italy, the United Kingdom and many countries of the European Union.

This important tax benefit, together with the extremely profitable performance of fine spirits, make the investment in collectible spirits one of the most preferred assets by investors. Unlike other alternative investments, which are certainly affected by market news and the various “fashions” of the moment, with consequent problems related to both performance and liquidation of the asset, investment in valuable spirits is characterized by its continuous increases in value and its ease of liquidation in the market with very important returns. Have a look at the performance of rare whiskey investments below.

Why invest with The Spirits Club?

Our expertise is to identify the labels suitable for investment purposes and capable of generating profits above the market average.

- Investment in rare and prestigious bottles worldwide

- High experience in the search and availability of bottles

- Product and management transparency

- Exclusive ownership of the investor

- Pool of experts at the top of world collecting in spirits

- Portfolio managers experienced in the management of luxury assets

- Ongoing advisory approach to investors

- Indication of the best moment of liquidation of the product

- Possibility to liquidate at any time in case of need.

As you can see above, whiskey investment is safe and profitable. Learn more from our free spirits investment guide.