The so-called Safe Heavens.

Investment in rare whiskies

Asset diversification fortunately allows us to lift through multiple investments among which to divide our capital. Below we will talk about the most profitable investments including rare bottles of whiskey and spirits.

Some investments are undoubtedly strongly correlated with market events, with the logical consequence that they are affected, to a positive or negative extent, by economic events and fluctuations in market value.

They are not, therefore, conservative investments of the invested capital, and are therefore not classified as safe haven assets.

Other investments, on the other hand, which have the main characteristic of being completely dissociated from market events, are first of all conservative investments of the invested capital and therefore fall within the classification of safe havens.

What characterizes and makes an investment safe haven is its dissociation from the market, and therefore, the lack of correlation to exogenous factors, which undoubtedly constitutes the first form of guarantee for our invested money.

Then there are, in the vast category of alternative investments, investments that are more guarantor than others and also more performing.

Clearly, this strong security is typical only of certain goods, in particular goods that are present in circulation in extremely limited quantities worldwide, whose research is complex and which enjoy a certain prestige and a position in the market so strong, that they have never known arrests or losses of value over time.

These are goods whose increase in value is not linked to events or economic factors as happens for most collectors’ items, nor does it depend on the fame of individuals or institutions.

These are rare whiskies and, more generally, valuable whiskies, whose prestige and value is unquestionably scratched in the global market.

Investing in rare whiskies and fine spirits means ensuring a considerable increase in your invested capital, with a guarantee of certain and immediate liquidation, given the very high demand for these products that generate a real competition between those who are able to win them first.

Who determines the profitability of investments?

What makes whiskey one of the most profitable investments?

There are extremely precise and important factors that allow some investments to be more profitable than others.

First of all, it is undoubtedly related to the increase in demand.

The only good that has been in great demand for decades is rare whisky.

The most authoritative international newspapers define it as the safe haven par excellence, thanks to its enormous demand and its very scarce offer.

The fine whiskey, in fact, is present worldwide in a too limited quantity, unable to satisfy the entire global demand that instead is constantly growing.

It is no coincidence that many celebrities, more attentive to an intelligent allocation of their resources, have founded their distilleries over the years, enjoying a great fortune in the years to come.

In fact, there are no other products on the market that can enjoy the same prestige, the same pressing and incessant demand and the same growth in constant value over time similar to that of rare whiskies and collectible spirits. That’s what makes whiskey and other spirits the most profitable investments.

But it is not a current trend, it is a trend that has lasted for years now and that has also led the large industrial giants of alcohol, to invest again by creating new distilleries in the market.

It is exactly this unstoppable demand typical of rare whisky, to make it outperforming compared to all other goods or securities that, on the other hand, do not enjoy the same growing demand, if not limited and limited to certain time periods.

What are the profits of the rare whisky

Past year returns and future forecasts

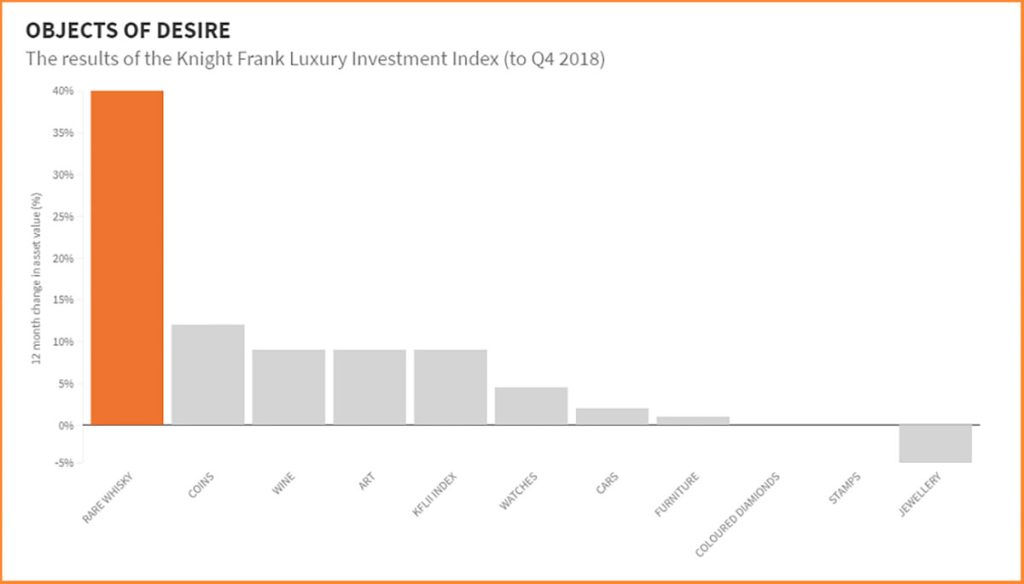

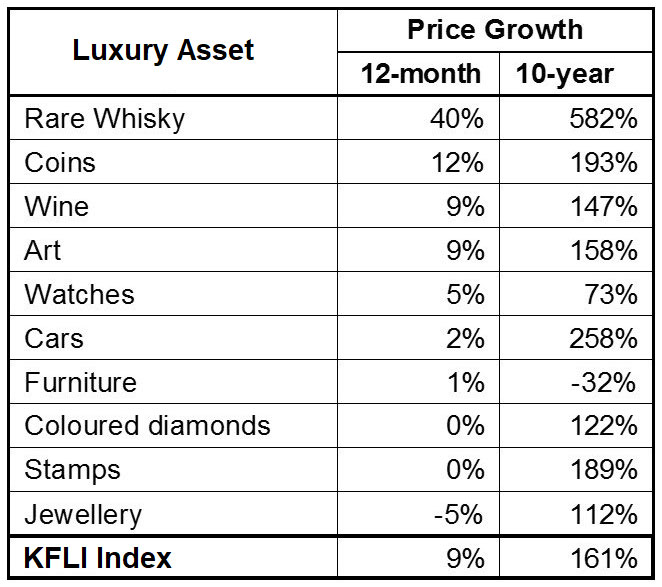

The Knight Frank Luxury index, the only authoritative index that compares and estimates the returns of the various alternative investments, has clearly placed the investment in rare whiskies and fine spirits for its very high performance in the ranking.

Over the past decade, its performance has reached average profits of 40% and ten-year profits of 582%.

These are numbers that only such a prestigious, rare and constantly requested good as fine whisky can give us.

The same forecasts, however, are also expected for the next decade, pushing important multinational companies to further finance the expansion of existing distilleries and arrange the creation of new distilleries in the market.

It is easy to see, however, how the investment in rare whiskies is able to make profits tripled, even compared to what is considered the second most performing asset of classic cars.

But it’s not just a question of performance.

Whenever considering investing in an asset, it is essential to consider the exit strategy, i.e. the ease of liquidation of that given asset.

That of vintage cars is an extremely complex market, in which the search for the future potential buyer of our car may not be so easy and immediate, with the logical consequence that we could regain possession of our invested money even after long years and we do not know for what amount, indeed.

But it is not only the vintage car market that is highly critical, it is certainly also that of watches and art and jewelry.

A market, on the other hand, such as that of fine collectible spirits in which the asset is always in continuous demand, allows to obtain a liquidation not only immediate, but also very profitable.

Why invest with The Spirits Club?

Our expertise is to identify the labels suitable for investment purposes and capable of generating profits above the market average.

- Investment in rare and prestigious bottles worldwide

- High experience in the search and availability of bottles

- Product and management transparency

- Exclusive ownership of the investor

- Pool of experts at the top of world collecting in spirits

- Portfolio managers experienced in the management of luxury assets

- Ongoing advisory approach to investors

- Indication of the best moment of liquidation of the product

- Possibility to liquidate at any time in case of need.

Want to learn more about getting started? Download our guide to investing in rare bottles of whiskey.