International sources

In particular: whisky as an alternative investment abroad. FINANCIAL TIMES, FORBES, BUSINESS EXPERT, THE GUARDIAN, FRED MINNICK, WARGA BIZ, CEO MAGAZINE, FORBES INDIA, FINANCIAL TIMES

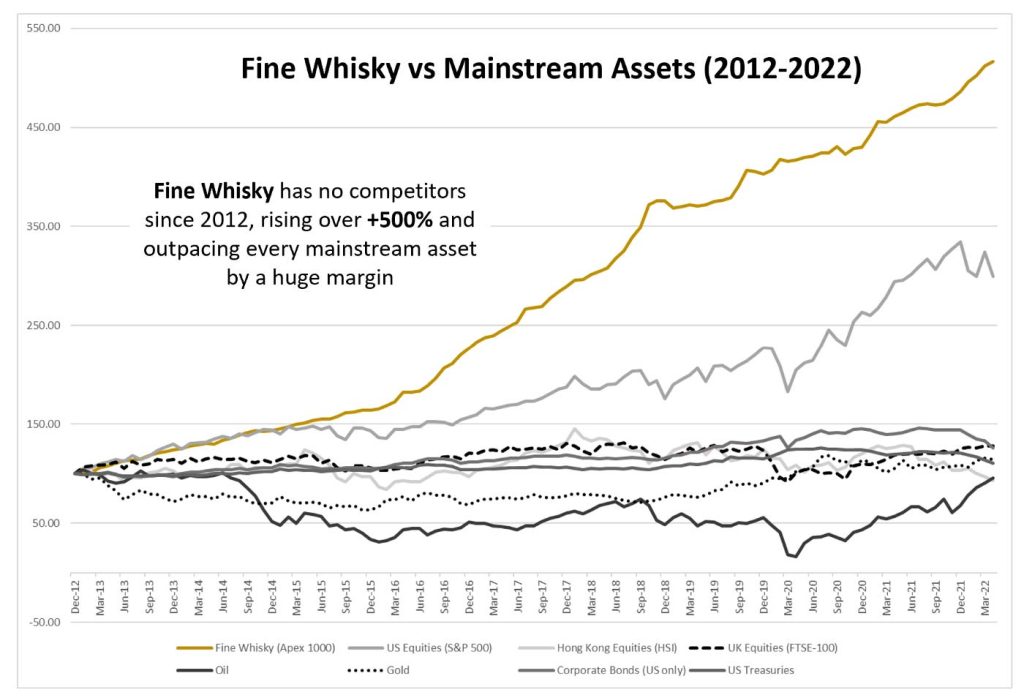

There are many newspapers of national and international importance that talk about the investment in collectible spirits, defining it, on several occasions, as the most performing alternative investment of the last decade and, the same trend, is also expected for the coming years. Investment in whiskey is a hot topic among investors and financial reporters.

Defined by the Financial Times as the best investment even compared to physical gold, the important results of fine whisky sales have not failed to be noticed.

Just to mention a few examples, in 2019 a bottle of Macallan Fine & Rare 60-year-old 1926 set its sales record with a quotation of about 1 million and 700 thousand euros; instead, in November 2018, another bottle from the same barrel was sold at the price of 1 million and 352 thousand euros.

Still, a beautiful glass bottle hand-blown by a Scottish glass artist of Bowmore 54 year old 42.1 ABV 1957, depicting an onda breaking on the island of Islay – the number 1 of only 12 bottles produced – was sold for the value of 420 thousand euros.

We could therefore safely say that inside a bottle of fine spirit can be the value of a real estate investment and beyond. The ancient origin of the prestigious distilleries and their very strong positioning in the market, make the bottles of whisky and rum, real collector’s trophies, and that is why the investment in whisky is an investment that knows no market crisis, even where the economy the rare whisky is the safe haven par excellence, as defined by many financial magazines.

Italian sources on investment in whiskey

In particular: IlSole24ORE, MONDO e FINANZA, FORBES, INVEST HERO, BEZINGA ITALIA, il Bollettino, FORBES, MILANO FINANZA, IlSole24ORE, Money.it, BORSA & FINANZA

Certainly, alternative investments are investments that are chosen by investors who do not like the thrill and at the same time the risk of seeing at the mercy of the markets the sum they have invested and, many times, subject to significant decreases in value.

Obviously, depending on the investment you choose, there are differences in profit, length of investment and liquidation period.

There are alternative investments that aredefinitely more profitable than others.

This is the case of investing in collectible spirits bottles.

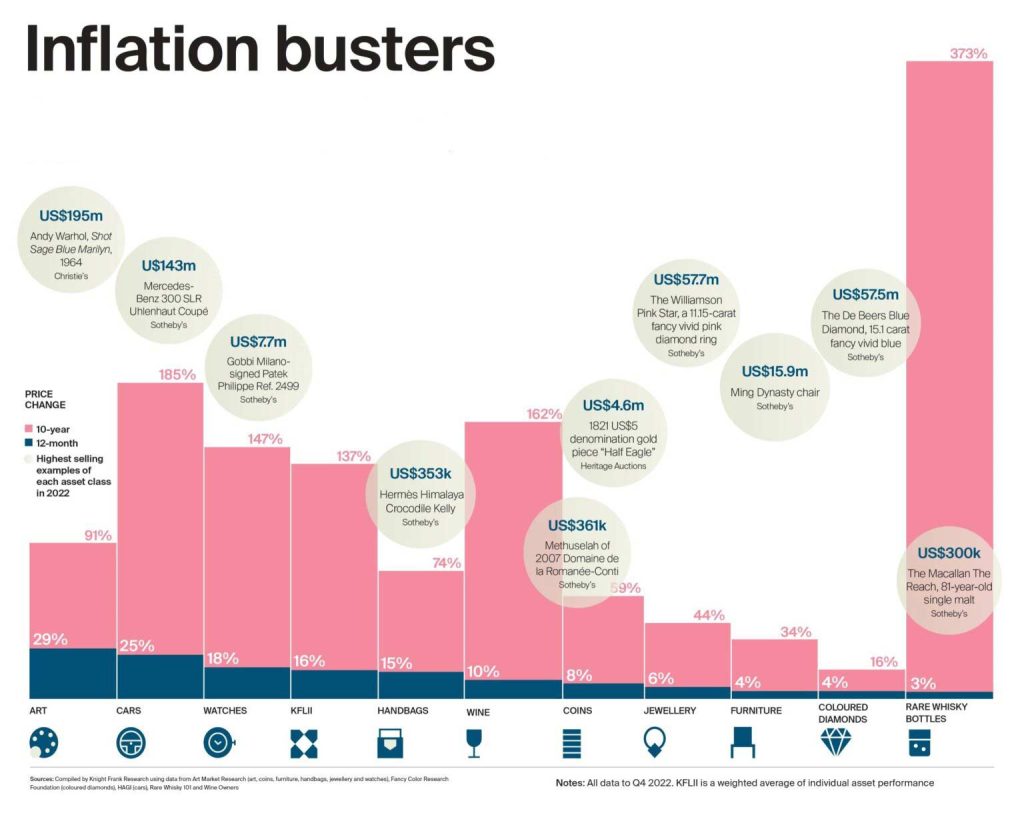

Their performance has been clearly highlighted on numerous occasions by the authoritative Knight Frank Luxury, as the highest ever compared to other alternative investments.

Not only that, the intrinsic and innate characteristic as a safe haven, allows investment in fine spirits to also be an excellent shield against inflation.

Among the most important reasons that make the investment in fine spirits so efficient there are certainly the strong market positioning of the historic producing distilleries, as well as the very scarce offer of the product worldwide.

Between Scotch and Japanese whisky, bourbon, rum and cognac in fact, the producing distilleries boast decades, if not centuries of production, giving life to spirits that also boast centenary aging and with dizzying figures able to envy the latest cutting-edge real estate investment.

The offer of bottles of fine spirits is in fact unable to satisfy the entire global demand, considering the very low production of quests and collections, which can sometimes consist of a maximum number of only 200 pieces and it is thanks to this great scarcity of their production and therefore of their presence in the market, that these bottles become real iconic collector’s items.

It is no coincidence, in fact, that the great giants of the market continue to invest in the creation of new distilleries, to offer greater production with the intention of grabbing an important slice of the market.

They talk about us: Investment in Whiskey with The Spirits Club

In particular: IlSole24ORE, Tiscali.it, Libero.it, Aska News, Affari Italiani, IlGiornaled’Italia, Quotidiano.net, La Nazione, Il Giorno, Il Resto del Carlino, Il Messaggero, Il Mattino, Il Gazzettino, Leggo.it, Il Quotidiano di Puglia, Corriere Adriatico, Il Dolomiti, Today.it, Zazoom, Daily Motion, Libero Quotidiano, Il Tempo

If you look back, you can clearly see that the profits on investment in fine whisky recorded in the last decade were 582% and the same trend is expected for the next decade, if not to a greater extent.

An overwhelming performance that has not given up even in the face of two years of pandemic that have bitterly wiped-out equity and non-equity portfolios.

Differentiating your portfolio and having a mindset accustomed to differentiating between multiple assets is dogma today, but the most important aspect that can protect an investor attentive to his finances is to position himself in a safe market corner and not subject to too many factors often dictated to favor or not economies.

Certainly, the lack of knowledge of safe and highly profitable investment opportunities can lead to depriving oneself of excellent or profitable investment opportunities.

The Spirits Club is a pioneer in acting as a spokesperson and spreading the investment opportunity in rare whiskeys and collectible rums, throughout Europe and beyond.

Our goal is to bring to the attention of many investors looking for a valid alternative to differentiate their resources, the great benefits and the very high potential of investing in whiskey and other spirits, still very little widespread or in the European area, but certainly well known in the most financially advanced countries such as America, America and the United Kingdom.

The most demanding collectors and investors, attentive not only to the differentiation of their assets but also to avoid the risk of fluctuations in invested capital due to market news and who have always allocated considerable resources to this form of investment, are present to an important extent in these areas.

The Spirits Club has been interviewed by the most important national newspapers that have not failed to arouse interest in investing in whiskey.

To invest you do not need to be an expert in the sector or a whiskey lover, because The Spirits Club takes care of managing the entire investment process for all its customers from the choice of the only performing collections, to the resale of the same in the market.

Why invest with The Spirits Club?

Our expertise is to identify the labels suitable for investment purposes and capable of generating profits above the market average.

- Investment in rare and prestigious bottles worldwide

- High experience in the search and availability of bottles

- Product and management transparency

- Exclusive ownership of the investor

- Pool of experts at the top of world collecting in spirits

- Portfolio managers experienced in the management of luxury assets

- Ongoing advisory approach to investors

- Indication of the best moment of liquidation of the product

- Possibility to liquidate at any time in case of need.

Want to learn more? Download our free guide to spirits investment.