What are alternative investments?

In particular: investment in collectible whisky and rum

The term “alternative” indicates something different from the classic investment and it is precisely to this difference that the so-called alternative assets refer.

While financial investments are normally closely related to market news, suffering for better or worse from its strong fluctuations, alternative investments are characterized by a complete dissociation from market events.

This means that the primary function of alternative investments is first and foremost to avoid market volatility, especially in times of uncertainty of the same, protecting the amounts invested from losses.

It is precisely this primary need for capital protection that distinguishes alternative assets.

Clearly, the absence of correlation with the market is a prime factor of choice but also these investments can offer higher returns than traditional ones, not surprisingly they are often preferred by sophisticated and wealthy investors who intend to secure their savings, also aiming to obtain important profits in the medium to long term.

However, one cannot make a generalization about it, in the sense that not all alternative investments are able to give these returns.

Why invest in alternative assets?

In particular: why rare whisky is the best performing alternative asset

Certainly, alternative investments are investments that are chosen by investors who do not like the thrill and at the same time the risk of seeing the sum they have invested at the mercy of the markets and, many times, subject to significant decreases in value.

Obviously, depending on the investment we choose, there are differences in profit, length of investment and liquidation time frame.

There are alternative investments that are definitely more profitable than others.

This is the case of investment in collectible spirits, or fine bottles of luxury whisky, rum and cognac.

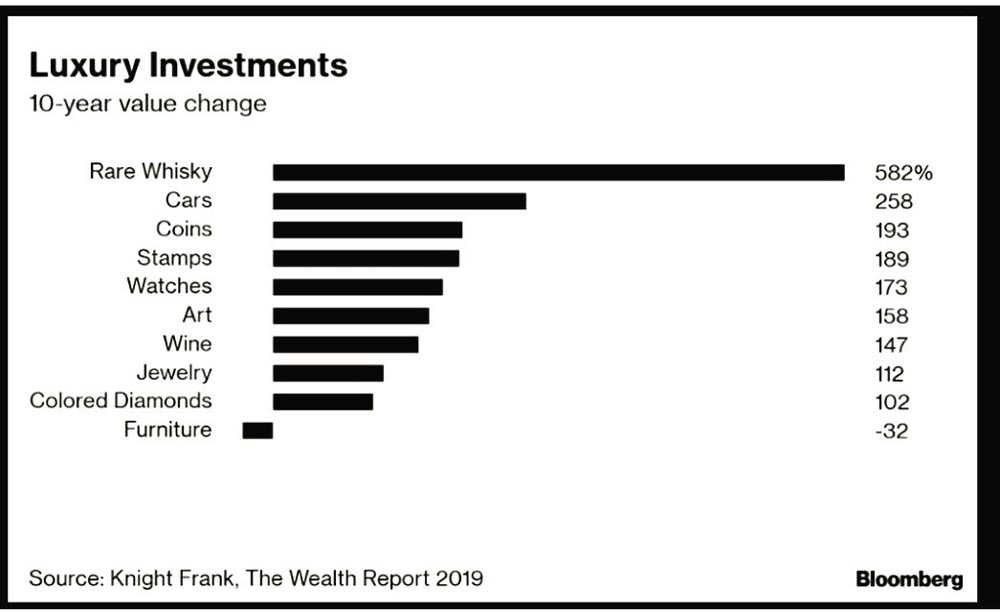

Their performance has been clearly highlighted by the authoritative Knight Frank Luxury index – which estimates and compares the returns of various alternative investments – as the highest ever compared to all other alternative investments.

If we look back, we can clearly see that the profits on investment in whisky of value recorded in the last decade were 582% and the same trend is expected for the next decade, if not to a greater extent.

Therefore, there has been no loss of value of these precious bottles, nor has the last pandemic managed to cause contractions in their value.

Certainly, rare whisky boasts its strength in the historicity of its brands and in the affirmation of the same in the market.

Between Scotch and Japanese whisky, in fact, the producing distilleries boast decades, if not centuries of production, giving life to distillates that also boast centenary aging. Their production, however, is so scarce, that it would be impossible to satisfy the entire global demand and it is precisely this great scarcity of their production and presence in the market, to make these bottles real iconic collector’s items.

What are the alternative investiments?

In particular: the profits from investing in rare whisky

Alternative investments include a wide range of investments.

Their variety allows investors to differentiate their portfolio by choosing the type of investment that best meets their needs.

Alternative investments include hedge funds, commodities, private equity, real estate, cryptocurrencies, gold, metals and precious stones, playing cards, stamps, vintage cars, comics, artwork, coins, bags, shoes, fine wine and rare whisky.

In particular, rare whisky, represents one of the oldest form of alternative investment, being able to be defined as a collector’s item, which has been attributed a positioning in the market and a value of a certain caliber thanks to its intrinsic prestige, its fame and its historicity.

For this reason, unlike other alternative investments that have seen their value lose over time or stand at the top of the value only for some periods, rare whisky has always boasted a great and constant growth in the market, which has allowed it to establish itself as the alternative investment with the highest returns ever, as shown by the graphs reported by the Knight Frank Luxury.

Source: Knight Frank, The Wealth Report 2019 – Bloomberg

Why invest with The Spirits Club?

Our expertise is to identify the labels suitable for investment purposes and capable of generating profits above the market average.

- Investment in rare and prestigious bottles worldwide

- High experience in the search and availability of bottles

- Product and management transparency

- Exclusive ownership of the investor

- Pool of experts at the top of world collecting in spirits

- Portfolio managers experienced in the management of luxury assets

- Ongoing advisory approach to investors

- Indication of the best moment of liquidation of the product

- Possibility to liquidate at any time in case of need.